Welcome to this 1 bedroom, 1 bathroom, 819sq.ft condo in Inglewood!

MLS#: E4322126 Welcome to Sierra’s of Inglewood, St. Albert’s most desirable condominium complexes. This well-maintained MAIN floor unit is bright & spacious with several large windows and beautiful upgraded laminate flooring. This open floor plan features one bedroom, living room, kitchen, and 4 piece main bathroom, including a convenient in-suite laundry room. Easy access to outdoor patio from the living room. Enjoy all the great amenities that this 35 + adult building offers: Indoor salt water POOL, sauna, guest suites, workshop, car wash, social room, pool table, library, and HEATED underground parking. Prime location: close to shopping, hospital, public transit, banks, restaurants, and walking trails. Fantastic opportunity for someone downsizing, or snow birds who love to escape the cold winters, or for the professional who chooses a carefree lifestyle. Available IMMEDIATELY!

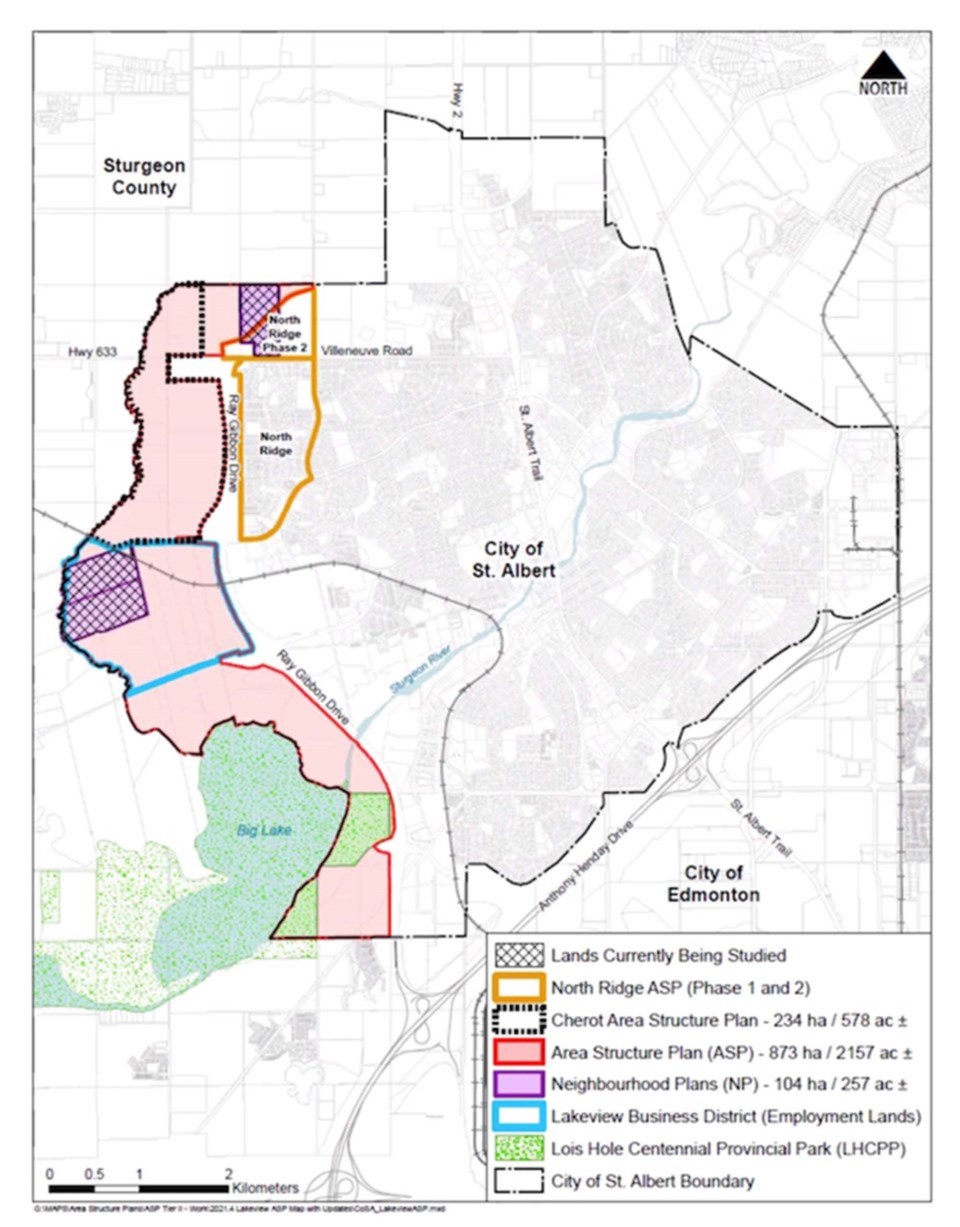

The City of St. Albert is working toward creating an area structure plan for the west end of the city, which will include the Lakeview Business District. The area will help expand the industrial space in St. Albert to allow for more businesses in the community.

The City of St. Albert is working toward creating an area structure plan for the west end of the city, which will include the Lakeview Business District. The area will help expand the industrial space in St. Albert to allow for more businesses in the community.