Source: https://member.ereb.com/WEB/Documents/pdf/2018-RAE-Commercial-YearEnd-Review.pdf

2018 RAE Commercial Year End Review

6 Questions to Ask Before Moving in Together

Source: https://www.real estate professional.ca/blog/postpage/7268/1362/6-questions-to-ask-before-moving-in-together/

It’s a big, exciting step in any relationship. Moving in together can save you both money and bring you closer together, but cohabitation is a major commitment and not one to take on lightly. Before you embrace domestic bliss, here are some questions you need to ask first.

WHAT ARE YOUR FINANCES LIKE?

It may be unpleasant to have “the awkward money talk,” but it’s an essential first step towards cohabitation. Have a frank conversation with your partner about your financial health. Being open about salaries, debt and financial goals will bring you closer together and make things a lot easier down the road.

HOW WILL WE SPLIT EXPENSES?

How much do you plan on contributing towards rent or mortgage payments? What about home insurance, bills, groceries and other household expenses?

For some couples, a 50/50 split works well. However, if there’s an income disparity between the pair, things can get muddy. A $1,000 contribution towards rent will mean something very different for someone earning $40,000 a year versus someone earning $120,000. For these couples, they may want to consider having each partner contribute a certain percentage of their income rather than a set amount.

Some couples decide to split costs in other ways—for example, one partner covers the bills while the other pays for groceries. What’s “fair” varies from couple to couple, but the most important part of managing your money while living together is communication.

WHAT IF ONE OF US ALREADY OWNS?

Things can get complicated when one partner owns their home and the other does not. If there’s a mortgage to pay down, the couple will have to decide what a fair division of housing costs looks like—do you split the mortgage down the middle, even though the “renter” part of the pair won’t be buying into any equity in the home?

There are other homeownership costs to think about, too, like property taxes, condo fees, hydro and heating/cooling bills and home insurance. What should each party contribute to each of those?

A simple way to break it down is to treat housing expenses as though the homeowner partner is your landlord. The homeowner bears all of the associated risks, including a decline in market value, expenses that would be associated with a future sale and any necessary upkeep or maintenance, so it makes sense to approach shacking up with this framework in mind. However, if things go sour, don’t forget the “renting” partner will be the one to move out–the person who’s not on the title of the home has no intrinsic right to it.

Another solution is to become a “tenant-in-common,” which would give the renting partner a percentage stake in the property. This can get messy, so proceed with caution.

Additionally, once a couple passes the common-law threshold–which varies from province to province but is typically three years–the rules can change entirely. At that point, a common-law partner could claim a portion of their partner’s property value as a result of any major renovations on your home completed without an agreement.

A final option is having the partner who owns rent his or her property to an entirely separate tenant so the couple can rent or purchase a new property together. If the couple breaks up, there’s little legal confusion over who owns the rental property. A REALTOR® can help you find the perfect home to fit your needs and budget as a couple.

WHO WILL SEND OFF THE RENT AND UTILITY PAYMENTS EVERY MONTH?

This may not seem like a big deal, but keeping up with bill payments is a logistical nuisance that can quickly build resentment between a couple. Make sure both of you agree on who pays what and when so there isn’t any nagging about payments down the line. If you decide your significant other will be the one in charge of paying the bills on time, make sure you still have a basic understanding of your financial health as a couple and where your money is going.

DO WE WANT A JOINT BANK ACCOUNT?

Many couples choose to open a joint bank account together for housing expenses, which makes paying rent or a mortgage or contributing to bills and groceries a breeze. With the ability to monitor all your collective household expenses, you have a much better understanding of your combined cash-flow and living costs. There are some drawbacks to a having a joint bank account, however. The last thing you want is for one partner to begin dipping in for extra cash, so proceed with caution.

SHOULD WE SPLIT FURNITURE OR BUY OUR OWN?

Keeping major purchases separate and documented will help save you a lot of grief in case of a breakup. Of course, when furnishing your place together, you may find you need to invest in some essentials. Decide in advance who pays for the new vacuum and who gets to keep it if things don’t work out.

In love and real estate, never make assumptions. Go over every financial detail together and plan ahead. Together, you can come up with a mutually beneficial and fair agreement hopefully ensuring cohabitating bliss for years to come.

[The article above is for information purposes and is not financial or legal advice or a substitute for financial or legal counsel.]

What you need to know about the three types of water heaters

Source: https://www.remonline.com/what-you-need-to-know-about-the-three-types-of-water-heaters/

CONVENTIONAL

Conventional tank-style water heaters can be powered by electricity, oil, natural gas, propane or even wood. This style not only heats the water, they also store the water once it’s been heated. This is why they’re so large. The tank’s water capacity usually ranges from 150 to 230 litres.

Non-electric, fuel-fired water heaters are equipped with a burner situated at the bottom of the tank. This allows the exhaust gases to travel through either the middle of the tank or around the outside of the tank to the exterior of the home.

TANKLESS

Tank-style electric water heaters have heating elements inside the tank that heat the water directly. Since there’s no heat lost through the generation and venting of exhaust gases, tank-style electric water heaters are 80 per cent to 90 per cent efficient.

Tankless water heaters can also be fueled by electricity, oil, natural gas, propane or wood. This style is relatively small and is usually wall-mounted and takes up very little space.

They are, however, significantly more expensive to purchase and install than traditional tank-style units. The water heater senses any time the hot water tap is turned on and ignites the burner or energizes the heating element. A larger element (or burner) will supply more hot water, which is much more convenient if two or more appliances require hot water at the same time. The energy savings from eliminating the off-cycle costs (keeping an entire tank of water heated overnight) can be as much as 10 per cent to 15 per cent.

SOLAR

Fueled simply by the sun’s energy, solar-style water heaters are typically used to supplement standard fuel-fired or electric water heaters, mainly because it can be difficult to obtain enough energy from the sun to heat water to necessary temperatures on an ongoing basis. Solar water heaters are characterized either as open-loop or closed-loop systems. An open-loop system circulates household (potable) water through the solar panel, where the water is heated directly by the sun.

A closed-loop system uses a heat-transfer fluid to collect heat from the sun and a heat exchanger to transfer the heat from the heat-transfer fluid to household water.

The off-cycle heat losses for both oil and gas-fired units can be reduced by insulating the tank and hot water pipes. Before installing insulation on a tank, it’s best to consult with a qualified heating contractor to determine the required clearance around the burners, exhaust vents and water pipes to ensure safety.

Coalition of health organizations push to raise awareness of radon

Source: https://www.remonline.com/coalition-of-health-organizations-push-to-raise-awareness-of-radon/

A coalition of national health organizations is urging Canadians to test their homes for radon, a naturally occurring and cancer-causing radioactive gas. The groups say radon is responsible for the deaths of more than 3,200 Canadians a year, which amounts to more deaths annually than car collisions, house fires, carbon monoxide poisoning and drowning combined.

The Canadian Cancer Society, the Canadian Association of Radon Scientists and Technologists (CARST) and CAREX Canada are launching Plan to be Here: an initiative that aims to raise awareness about the cancer risks associated with radon and the importance of having homes tested.

“Many Canadians are unaware that radon is the leading cause of lung cancer in non-smokers,” says Pam Warkentin, executive director of CARST and project manager, Take Action on Radon. “Just as it’s now second nature for Canadians to buckle their seatbelts and change the batteries in their smoke detectors, we need to encourage people to take action to reduce their cancer risk and test their homes for radon.”

Radon is a radioactive gas that is present in the air and can accumulate in high concentrations in homes. Long-term exposure to high levels of radon damages the DNA in lung tissue and can lead to increased lung cancer risk, say the groups.

According to Health Canada, more than one million Canadian homes have high radon levels.

“Radon can find its way into any home, regardless of location, age, upkeep or design,” says contractor and TV host Mike Holmes Jr. “Help keep your family safe and get your home tested for radon levels. Testing is easy, and if your home has high levels of radon, the mitigation process is straightforward and affordable.”

Kelley Bush, manager of Radon Education and Awareness for Health Canada, says Canadians need to be more proactive when it comes to protecting themselves and their loved ones from radon exposure.

“A recent study commissioned by Health Canada found that only six per cent of Canadians have tested their home for radon,” says Bush. “We need to increase that number.”

From left: Jenny Byford, advocacy lead, cancer control, Canadian Cancer Society; Mike Holmes Jr, contractor and TV host; Erin Curry, executive assistant, CARST; Kelley Bush, manager, radon education and awareness, Health Canada; and Pam Warkentin, executive director of CARST and project manager, Take Action on Radon.

A landlord-tenant privacy quiz

Source: https://www.remonline.com/a-landlord-tenant-privacy-quiz/

All private businesses across Canada, including residential landlords and real estate brokerages, will be impacted by the latest changes to the Personal Information Protection and Electronic Documents Act (PIPEDA) beginning Nov. 1. PIPEDA is Canada’s federal private sector privacy law that sets out the ground rules for how businesses, including landlords, must handle personal information in the course of their commercial activity. PIPEDA was significantly amended when the The Digital Privacy Act received Royal Assent in June 2015.

Under PIPEDA, landlords must:

– Obtain a tenant’s consent to collect, use or disclose a person’s personal information.

– Identify the reasons for collecting the personal information before collection and only ask for the limited information needed for what a reasonable person would consider appropriate to the circumstances.

– Provide an individual with access to the personal information the holder has about the individual and allow them to challenge its accuracy.

– Only use a tenant’s personal information for the purposes for which it was collected.

The time limit for PIPEDA court applications changed from 45 days to one year.

As of Nov. 1, PIPEDA will include a mandatory requirement for organizations to give written notice to affected individuals and to the commissioner about privacy breaches and to maintain records for 24 months about each breach.

All businesses (and landlords of every size) must ensure that personal information is protected by appropriate safeguards including physical measures (locked filing cabinets, restricting access to offices, alarm systems), technological tools (passwords, encryption, firewalls) and organizational controls (security clearances, limiting access to a “need-to-know” basis, staff training, agreements).

You say you knew all this already? What about the case where a landlord and tenant had a verbal tenancy agreement (permitted under the RTA) to allow the tenant to grow up to four cannabis plants but the landlord discovered 60 plants? Here’s the answer.

The full implications of PIPEDA to Canadian businesses would require possibly a small book to analyze the obligations for every type of small business. My personal focus is on residential “landlording”, which includes Realtors who assist residential property investors, so here’s a 20 Question Landlord-Tenant Privacy test:

1. Do you need a tenant’s SIN number for most things?

2. Do you need permission to capture a tenant’s face on a surveillance camera?

3. Do you need written permission to do a credit check?

4. What minimum information is needed to do a credit check?

5. Is it against the law to demand a tenant’s SIN number?

6. Can you deny a tenancy applicant because they didn’t give you their SIN number?

7. Can you use the SIN as a general tenant identifier, for example in your accounting system?

8. Can a landlord ask for a driver’s licence, tax information, pay stubs?

9. Can you look into a tenant’s background by looking at social media postings or calling another landlord?

10. Can you put a tenant’s name on a “bad tenant” list?

11. Can you verbally disclose bad tenant behaviour to other landlords, for example a phone reference?

12. Can you take pictures of a tenant’s apartment and contents if you suspect a tenancy agreement breach?

13. Can you set up surveillance cameras in your building that capture tenant faces?

14. Can a tenant ask what information you hold about them?

15. Can other tenants collect information on a tenant?

16. How long can you retain a tenant’s information?

17. Is there a prescribed process for personal information destruction?

18. Can you disclose personal information to pursue a debt?

19. Can police agencies demand tenant information from you?

20. Can police agencies demand the landlord allow them entry to a tenant’s unit?

Short (and incomplete) answers:

1. No.

2. Yes, but can be implied.

3. Yes.

4. Name, address, date of birth.

5. No law currently prevents landlords from asking for a SIN for purposes such as identification.

6. No.

7. No.

8. Privacy law doesn’t prevent such requests but information must be fully protected.

9. Informal checks are a collection of personal information – permission required, privacy laws apply.

10. Not to an unregulated or ad hoc list.

11. No.

12. Strict rules apply.

13. Strict rules apply.

14. Yes.

15. Generally, no.

16. No prescribed period but not indefinitely.

17. No but “must be done appropriately”.

18. Strict rules apply. Disclosure to a tenant’s family, co-workers or on social media is not allowed.

19. Strict rules apply, specific documentation required.

20. Maybe, if police declare it an emergency. Otherwise, warrant usually required or 24-hours’ notice to tenant. Strict rules apply.

Now, be honest with yourself: how well did you score? More importantly, do you have all of the above risk exposures covered in your Rental Application form and Standard Lease appendix B clauses?

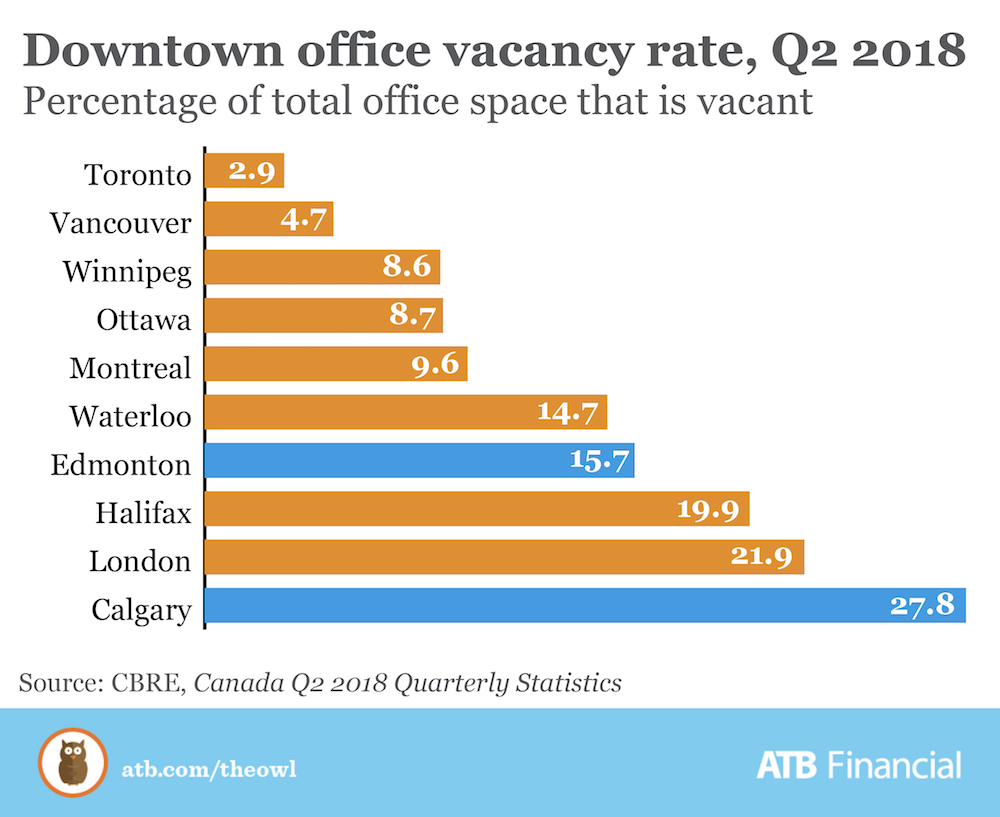

Office space available: downtown vacancy rates

Source: https://mailchi.mp/7bc2bab1cd7e/office-space-available-downtown-vacancy-rates?e=6f1f3fb3a5

There are many ways to gauge how an economy is doing. One way is to look around a city’s downtown to get a feel for the “hustle and bustle”. A related, but more objective measure, is the office vacancy rate.

According to this measure, Calgary is still reeling from the recession. The city has a downtown office vacancy rate of 27.8 per cent. Edmonton is faring better but still not great, at 15.7 per cent.

There are two main factors affecting these rates. The first is the amount of new space coming on the market thanks to construction. The second is the demand for office space.

In this sense, Calgary has been hit with a double blow. Prior to the recession, the red hot economy fuelled a construction boom. That, combined with layoffs in the oil sector, has pushed the vacancy rate from about ten per cent before the downturn to its current elevated level.

Edmonton experienced a similar situation. A number of major new building projects added to the available office space during the downturn. Edmonton has seen its vacancy rate fall by about five percentage points over the last year but the completion of the giant 69-storey Stantec Tower might cut into these gains.

The silver lining of a high office vacancy rate is that businesses in need of space have more options in terms of price and quality. Nonetheless, the stubbornly high vacancy rates in Alberta’s two largest cities point to the slow nature of the economic recovery.

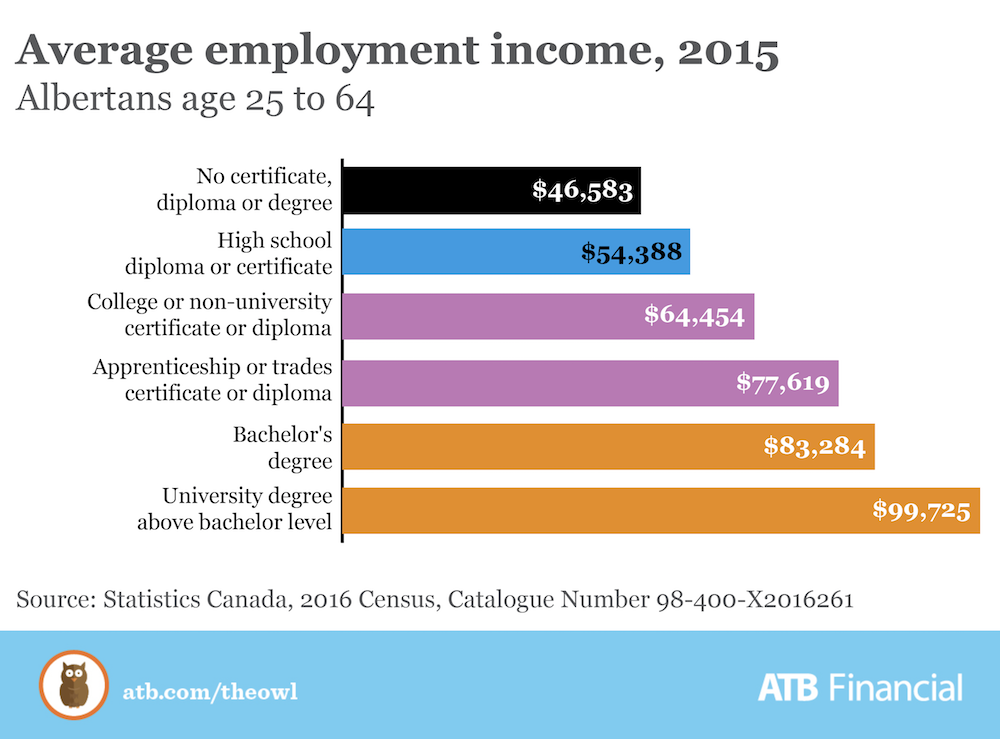

ATB’s Perch explores higher education in new podcast!

Source: https://mailchi.mp/713be547dd40/the-owl-atbs-perch-explores-higher-education-in-new-podcast?e=6f1f3fb3a5

From learning about the human condition to encountering different perspectives to developing critical thinking skills, there is a wide range of benefits associated with post-secondary education, but getting a well-paying job afterward is often at or near the top of the list.

According to the 2016 Census, the average employment income of Albertans age 25 to 64 was around $47,000 for those with less than a high school education. Completing high school is associated with a $7,800 bump in average employment income. Multiplied by just five years, that’s $39,000 of additional income.

Average income goes up even further among Albertans who have completed a post-secondary program of some kind. Average employment income is highest among those with a university degree, followed by Albertans who learned a trade and those with a college diploma. The annual earnings gap between Albertans with less than high school and those with a degree above the bachelor level is a whopping $53,000.

Completing a post-secondary program requires investing a significant amount of time, energy and money and there is no guarantee that it will lead to a well-paying job. With that said, the higher level of employment income associated with having a post-secondary credential suggests that it is a worthwhile investment.

Kelowna and Edmonton set to be ‘hot spots’ in cannabis real estate: RE/MAX

Source: https://www.mortgagebrokernews.ca/business-news/kelowna-and-edmonton-set-to-be-hot-spots-in-cannabis-real-estate-remax-249157.aspx

Two cities in Western Canada have been named the next commercial real estate “hot spots” for the cannabis market, according to a report.

Real estate firm RE/Max Commercial says that Kelowna, B.C., and Edmonton are both expected to see positive commercial growth in the coming months as a result of cannabis legalization.

Prices for commercial real estate in the southern B.C. city are anticipated to see an uptick, as approval for cannabis retail licences will be “extremely competitive” amid high demand once the substance becomes available.

Kelowna, which is located in the Okanagan Valley, has already identified more than 900 potential zoned sites for dispensaries.

Lease rates for industrial spaces in the area are also expected to rise as marijuana companies vie for more space to house their operations, says the annual Commercial Investor report.

This increase comes after Kelowna’s real estate market saw an eight per cent decrease in total sales value for its commercial property year over year.

Meanwhile, it is anticipated that vacancy rates will continue to drop and lease rates will rise moderately for the remainder of the year in Edmonton thanks to the arrival of Aurora Cannabis.

New construction, particularly in the Leduc and Nisku areas of the city, has been burgeoning amid the addition of a 74,322 square metre (800,000 square foot) medical marijuana production facility and a 37,161 square metre (400,000 square foot) auto parts and distribution warehouse from Ford Canada.

“Cannabis is adding an additional demand segment to the overall market, for industrial or retail,” said Elton Ash, regional executive vice-president at RE/MAX of Western Canada on Wednesday.

“It’s good news from a landlord perspective.”

The Canadian Press

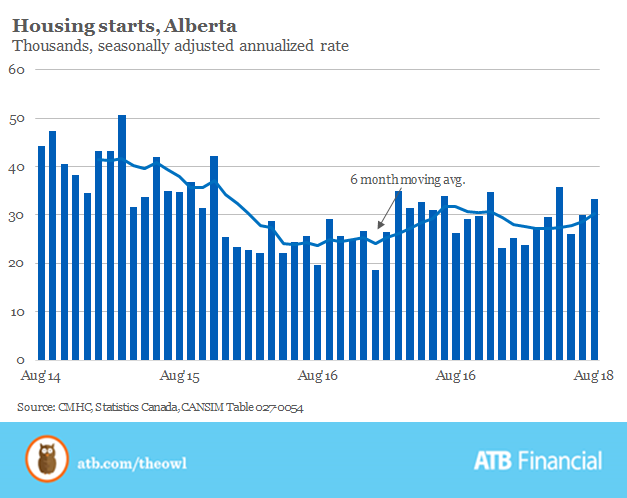

Housing starts jump up again in August

Source: https://mailchi.mp/9868f5ec9741/the-owl-housing-starts-jump-up-again-in-august?e=6f1f3fb3a5

Higher levels of supply and stagnant house prices in Alberta’s main cities aren’t doing much to slow housing construction in our province.

In August, builders started construction on 33,270 new homes. August’s pace of building was 11 per cent greater than July and two per cent greater than the same month a year earlier. August’s figure is adjusted for seasonality and shown at an annualized rate (that is, it is the number of new homes that would be built in a full year if the same pace of activity was sustained for 12 months).

Housing starts are a great measure of economic performance. As more people work, earn money, and feel confident about their jobs, they buy new houses and condos. Given that housing starts are on the rise and well above the 12-month average, we should feel optimistic about the economy. However, when we dig into other housing data a little more closely, there are a few surprises that suggest housing starts could begin to trend lower.

In Edmonton and Calgary, for example, both cities are experiencing high levels of inventory, lower sales activity and house prices are flat, too. Normally, weaker sales activity and a falling price would halt construction on new homes. Albertans are also having to deal with costlier borrowing and stricter lending rules that were introduced at the beginning of the year.

The combination of lower sales activity, falling prices, more expensive lending and harder mortgage qualifications are doing little to stop the pace of new home construction, at least for now. In the coming months, however, we can expect housing levels to begin to trend lower.

Pitfalls of gifting a home to your child

While mixing family and money is a cardinal sin, it’s being done in Canada on a daily basis. The reason: the Canadian housing market is so hot that millennials can’t touch it alone. Parents are “gifting” or selling their rental properties to their children for a nominal value. While this is a valid strategy, there are several important factors to consider.

As someone who worked in many law firms, it never ceased to amaze me as to how seemingly happy siblings from functional families squabbled over the scraps of their parent’s estate. Buried feelings of “mommy treated you better” invariable surfaced when it came to money and, more importantly, what to do with their parent’s home.

If you are a parent of more than one child, you may want to consider the potential disputes that will invariably arise if you decide to sell or “gift” a home to one child and not the other. To prevent disputes over whether or not the non-receiving child was fairly compensated or whether or not the sale was fair, it’s imperative that the property be evaluated by at least three different independently chosen appraisers.

With several appraisers providing an independent opinion, it would be difficult for the siblings to claim that the property was undervalued. What’s more, if the child is actually paying the fair market value for the home, several appraisals will help refute future claims by the taxman that the value of the home and, therefore the adjusted cost base (an important component of determining the child’s capital gains, as discussed below), was lower than what the child paid.

If you give or sell an asset to a child, you’ll be deemed to have sold the asset for fair market value. This is true even if you sell the property for much less. For example, if a parent “sells” to their child a property that isn’t a principal residence for $1, and the true value of the property is $1 million, then the parent will have to pay tax as if the home sold for $1 million and not the $1.

The parents may use the principal residence exemption to shelter the tax on the sale to their child, however, this only “pushes” the tax issue down the line. Using our earlier example, the child who “bought” the property for $1 will be hit when she sells the house.

Assuming she sells the home for $1.1 million, she will pay a capital gain on $1,099,999, which is the difference between the amount paid ($1), also called the adjusted cost base, and the sale price ($1.1 million). This is in stark contrast with the amount that would’ve been taxed – $100,000 – if she actually bought the home for its fair market value (the difference between what the house was truly worth at the time it was sold to the child ($1 million) and what it sold for ($1.1 million).

In order to avoid significant tax implications, parents could sell the properties to their children for fair market value and take back a mortgage on the property and waive all payments. This approach allows for the deferral of a capital gain on the properties of up to five years. The parents may also revise their wills to state that these loans be forgiven upon their death. This approach further means that the adjusted cost base is higher, causing the capital gain to be reasonable for the children if they sell. Despite this more favourable approach, there are several other estate and tax issues that may arise. Professional advice is advisable.

When selling property to family members, it’s also imperative to stipulate how the property will be shared and maintained. Parents and siblings may assume that its current use will continue, leading to certain feuds. Consider a family cottage, for example. What happens on weekends? Are all family members able to continue to show up announced? If so, who will be responsible for the maintenance and upkeep of the home? What are the costs involved? These questions must be answered and put in writing to ensure a smooth transaction and avoid the old cliché that one should never mix money and family.

August job report best yet this year

“Source: https://mailchi.mp/53cd70d61bc7/the-owl-august-job-report-best-yet-this-year?e=6f1f3fb3a5

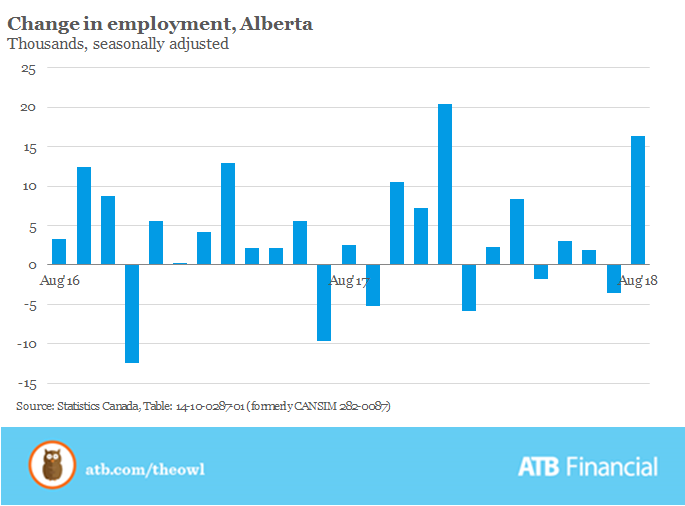

Alberta’s labour market roared back to life in August, adding 16,300 net new jobs after the setback in July. August’s job total was the best of this year and the highest since December 2017.

The majority of new jobs added to the economy last month were full-time (11,000). Although the number of net new full-time positions is only half of what was lost in July, the quality of work being added to the provincial economy continues to improve.

From July to August, job gains were recorded in ten different sub-sectors, the most notable being business, building and other support services (+6,300), professional, scientific and technical services (+4,700) and construction (+2,600). Last month, oil and gas jobs recorded the largest decline (-2,100).

Even though more jobs were added to the economy, more Albertans were actively searching for a job. In other words, the size of the labour force grew. As a result, Alberta’s average unemployment rate was unchanged at 6.7 per cent.

Alberta’s economy has added more than 52,000 jobs compared to last year. On the surface, this looks promising. However, many Albertans can attest things have not been so easy. Alberta’s labour market has seesawed throughout the year, a reality that continues to prove frustrating for those looking for work.”

– August job report best yet this year

Albertans’ online spending habits: Part One

Source: https://mailchi.mp/1cd2a6b827c3/the-owl-albertans-online-spending-habits-part-one?e=6f1f3fb3a5

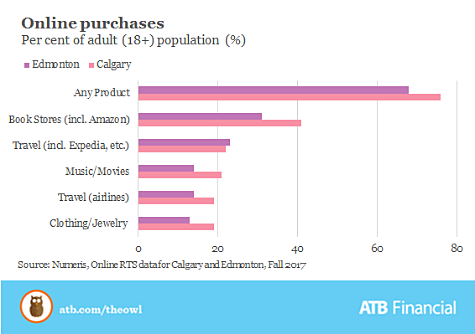

Online shopping sites like Amazon and eBay are drastically changing the way many of us shop. More Albertans are starting to scour the web for the best deals on toilet paper, vacations and even food. Today’s version of The Owl will take a look at Albertans’ online shopping habits and break the numbers down between Calgary and Edmonton.

Calgarians do more online shopping than Edmontonians. According to data from Numeris, a polling firm that focuses on consumer behaviour and media consumption, 76 per cent of Calgarians over the age of 18 made a purchase online in the past year. In Alberta’s capital city, only 68 per cent of people aged 18 or over opted to buy something this way.

The most popular online purchase category in both cities was internet bookstores. This section includes sites like Amazon and other booksellers and ebook sites. In Calgary, just over 40 per cent of online shoppers bought something through this category. In Edmonton, that number was slightly less, coming in at 31 per cent.

Travel was the second most popular category among online shoppers in Calgary and Edmonton. In Edmonton, 23 per cent booked travel through a travel site like hotels.com. The number was about the same in Calgary, coming in at 22 per cent. When booking directly through an airline’s site, 19 per cent of adults in Calgary and 14 per cent of adults in Edmonton bought tickets this way.

Online music and movies was the next most popular catergoy. One in five Calgarians paid for or purchased and downloaded music and movies online in the last year. Edmonton’s activity in this category was lower, with only 14 per cent of adults buying music and movies online.

Many of us have ordered jeans, dresses, shirts and shoes online but, contrary to what you might think, only 19 per cent of Calgarian online shoppers made clothing or jewelry purchases in the last year. That number was 13 per cent in Edmonton.

How much will it cost to buy a home?

Source: https://blog.remax.ca/much-will-cost-buy-house/

Buying a home is a big investment – likely the largest one you will ever make. The cost to buy a home should be carefully considered to avoid the risk of financial difficulty in the future.

Since this decision has a large impact on your wallet, we want to take some time to explore the many costs associated with buying a home. Doing your homework and knowing the average cost of these services in your neighbourhood will help you choose a home within a realistic price range.

Deposit: Depending on your location and the price of a home, you may need to put a deposit on a home as a security measure to ensure you don’t lose it to another interested buyer. If you are required to pay a deposit, it will become part of your down payment once you have purchased the home.

Down Payment: In Canada, the minimum amount you need to put down on a home is 5%. While this is realistic for most first time home buyers, having a down payment of 20% or more will help buyers avoid paying Mortgage Loan Insurance.

Land Transfer Tax: When you buy a home, you are required to pay a land transfer tax to the province upon closing. This tax is normally based on the amount paid for the land, as well as the remaining amount on any mortgage or debt assumed as part of the arrangement to buy the land. Cost will vary depending on your municipality, the size of the land and other factors. Alberta, Saskatchewan, and parts of Nova Scotia do not have Land Transfer Tax at all, while other provinces use a tiered system.

Appraisal Fee: An appraisal will normally cost between $200 and $300 but can vary depending on your location. This will help prevent you from borrowing more than you need to, and will prevent lenders from giving you too much.

Home Inspection: A home inspection is a necessary step in your home buying process and will normally cost an average of $350 depending on the size, age, and condition of the home. This helps ensure there are no unexpected maintenance or home improvement costs upon purchasing the home.

Property Insurance: While property insurance is likely already something you have factored into your budget, it’s important to do your research and find a reasonable quote that will ensure you are covered should anything unexpected happen.

Mortgage Insurance: There is mortgage life insurance, which is designed to protect the repayment of a mortgage if anything were to happen to you. There is also mortgage loan insurance if your down payment is less than 20% of the total house cost. Premiums for this type of insurance range from 0.5% to 3% and increase if you are self employed.

Lawyer Fees: The fee you will be charged by your lawyer will vary depending on the person representing you and must be paid upon closing. Ask your real estate agent for advice as they likely have a preferred trusted lawyer they can refer you to.

Title Insurance: Title insurance is a one-time-fee that provides protection from losses related to the properties title or ownership. Learn more about what it is in this blog post.

Property Taxes: The cost for property taxes is expressed as a dollar rate for every $1,000 estimated to be the market value of your property.

Maintenance and Energy Costs: Potentially your largest ongoing homeowner expense, these costs include lawn care/ yard work, professional services, additions/upgrades and the cost of keeping the house running year-round. You can use our monthly home budget planner to help map out all of these costs.

Moving Expenses: It’s easy to forget about the small things when moving, but it’s important to remember they can add up quickly! Consider the cost for phone, electricity, and other utility installations and don’t forget about movers, a moving truck and feeding your friends who are helping out!

Now that you have a better idea of the cost to buy a home, it’s time to hit the books to find out how much these services will cost in your area. Make a list, create a budget, and get started!

Download our Hidden Costs of Home Ownership guide to find out more the cost to buy a home. Looking for information on a cost not listed above? Leave a comment & we will do the research for you!

Farming profitability up last year

Source: https://mailchi.mp/0d21e2ec0a06/the-owl-farming-profitability-up-last-year?e=6f1f3fb3a5

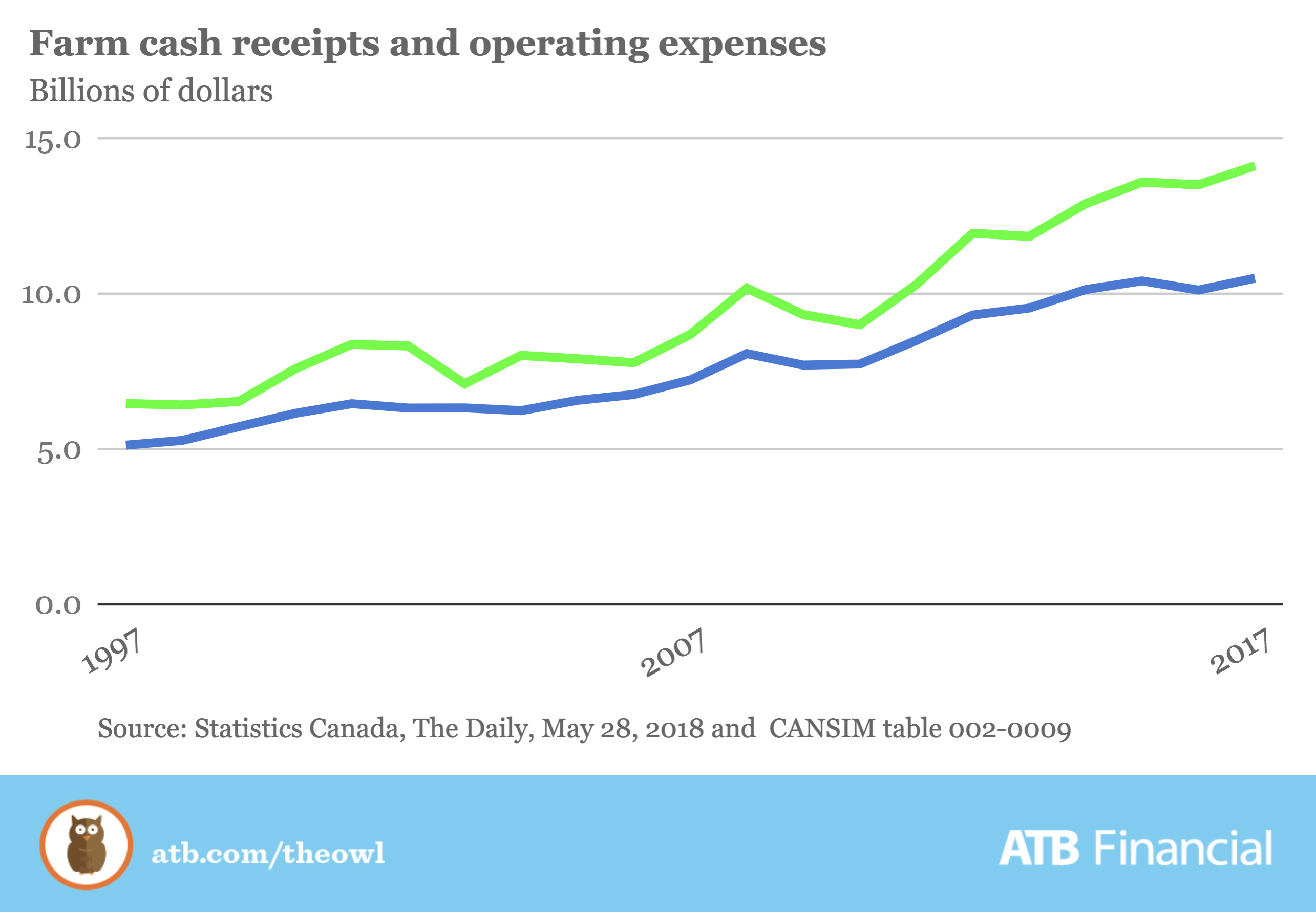

The Owl took a peek at farm cash receipts in Alberta yesterday. Statistics Canada reports on two categories: crop receipts, which racked up a new record high of $6.9 billion, and livestock receipts, which weren’t far behind at $6.4 billion. Combined, it was the highest year on record for total farm cash receipts.

But what about operating costs? How have the expenses associated with farming risen over time and how profitable has agriculture been lately?

The graph below shows Alberta’s total farm cash receipts (including crop, livestock and direct payments such as insurance claims) compared to operating expenses. Both have climbed over the last 20 years with the gap widening nicely in recent years in favour of increased profitability.

In 2017, cash receipts were $14.1 billion and operating expenses were $10.5 billion, yielding a net income of $3.6 billion. That was a record high. Statistics Canada also calculates a measure of “realized net income,” which takes net cash income and subtracts depreciation on equipment and machinery. Realized net income from agriculture in Alberta was $1.8 billion, also a record high.

Hard work, innovation and expert management on the part of Alberta’s farmers have been instrumental to the sector’s strong performance in recent years. But even the best management can’t overcome all the challenges created by bad weather. With the 2018 growing season underway, let’s hope the weather cooperates and that 2018 is another record-breaking year.

Oil production in Alberta is up

Source: https://mailchi.mp/8a62d2dbbda8/the-owl-oil-production-in-alberta-is-up?e=6f1f3fb3a5

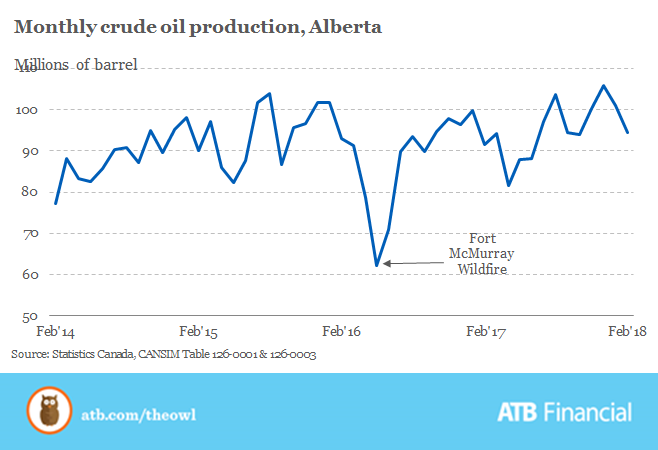

With all of the news on oil and pipelines this week, its timely for The Owl to examine what’s happening with oil extraction in our province.

According to the latest oil supply and disposition statistics, oil extraction in Alberta is up over the last 12 complete months. As of February, 94 million barrels of oil were extracted in Alberta, three per cent higher than February of 2017. Over the last 12 complete months, oil production has grown by over eight per cent.

As the chart below shows, extraction remained strong in almost every month over the course of the downturn. In fact, oil production reached a record at the end of last year with 105 million barrels of oil produced in the province in December. The rising production levels are due to several major oil sands projects coming online, stronger prices and the desire to strengthen company balance sheets given the stress they were under during the recession.

So, what’s in store for Alberta oil production in the long-term? With the recent news of the Trans Mountain Pipeline, more producers may be thinking about increasing production to sell oil in the lucrative Asian markets. The pipeline, of course, still has to get built for this happen.

Will legal home-grown pot hurt sales?

Source: http://www.remonline.com/will-legal-home-grown-pot-hurt-sales/

There’s been much huffing and puffing over the legalization of recreational marijuana, with various groups – including the real estate industry – calling for the federal government to postpone the roll out of legal pot consumption until clearer regulations are in place.

One of the most hotly contested issues is that of home pot cultivation; under the federal legislation, Canadians can grow up to four plants within private residences. This could lead to all sorts of unintended consequences, warns CREA, from physical damage to an unshakeable stigma that can devalue a home.

In addition to the potential for mould or electrical damage, the Ontario Real Estate Association (OREA) is concerned it will be increasingly difficult to disclose whether a home has been a marijuana grow site. And because there currently is no legal definition of what constitutes a grow-op (a full-scale operation or single potted plant could potentially be treated equally under the eye of the law), there is no official remediation standard to undo resulting damage. That can leave homeowners, sellers or buyers with little recourse should their home be blacklisted by a lender or insurer.

But are Canadian home buyers really bothered by the presence of legal pot?

According to new national survey data, when it comes to homes where pot has been puffed, buyers would rather pass. Nearly 47 per cent of 1,400 respondents across each province indicated they would think twice about purchasing a home where marijuana has been grown, even if it was within the legal limit.

Respondents from Quebec were most likely to not consider a home where pot had been present at 52 per cent (the provincial government has stated it will not allow at-home pot cultivation at all, though this could be contested at the federal level).

Forty-eight per cent of respondents from Ontario and British Columbia, where home cultivation will be allowed, indicated as such, followed by 47 per cent of those from Manitoba and Saskatchewan. Respondents from the Atlantic region were least likely to second-guess their home purchase, at 31 per cent.

Thirty-nine per cent of respondents also felt that increased marijuana use within a home would effectively decrease its value; Quebec again led respondents at 45 per cent, followed by Ontario, at 41 per cent. British Columbians and those from Manitoba/Saskatchewan both reported 37 per cent, followed by Albertans and those in the Atlantic provinces, at 31 and 26 per cent, respectively.

Thirty-two per cent of Canadians also indicated concern that living in close proximity to where legal marijuana is sold would negatively impact their property values.

As well, most respondents indicated they do not plan to grow their own marijuana at home, regardless of age group. While millennials are most likely to cultivate their own pot, at 19 per cent, 64 per cent indicated they would not, while 16 per cent remain unsure.

Seventy per cent of Gen Xers say they will not be using their green thumbs (14 per cent plan to grow, while 16 per cent aren’t sure). Boomers are the least likely, with 75 per cent indicating no, 14 per cent unsure and 11 per cent agreeing.

To address such concerns, real estate associations have made a variety of proposals to government to better provide clarity and protections for homeowners who may wish to cultivate pot, or purchase one where it has been grown.

In April, OREA brought forth a five-point Action Plan for Cannabis Legalization, which included a call for an established remediation standard. It would require a grow home’s status to be placed on title until required repairs are made, as well as improved standards for home inspectors. OREA also proposed reducing the legal limit of plants from four to one in multi-residential units smaller than 1,000 square feet.

CREA has taken it a step further and called for the federal government to hold off on allowing indoor grows altogether “until the government can enact rules and regulations for the entire country”.

Barb Sukkau, CREA’s president, laid out the association’s concerns in a statement. “We’ve heard from homeowners and tenants across the country who are worried about living beside grow-ops,” she said. “What does this do to their home values? Will this increase their rent? How safe will their kids be? Will their quality of life diminish because of the prevalence of drugs in their neighbourhood?”

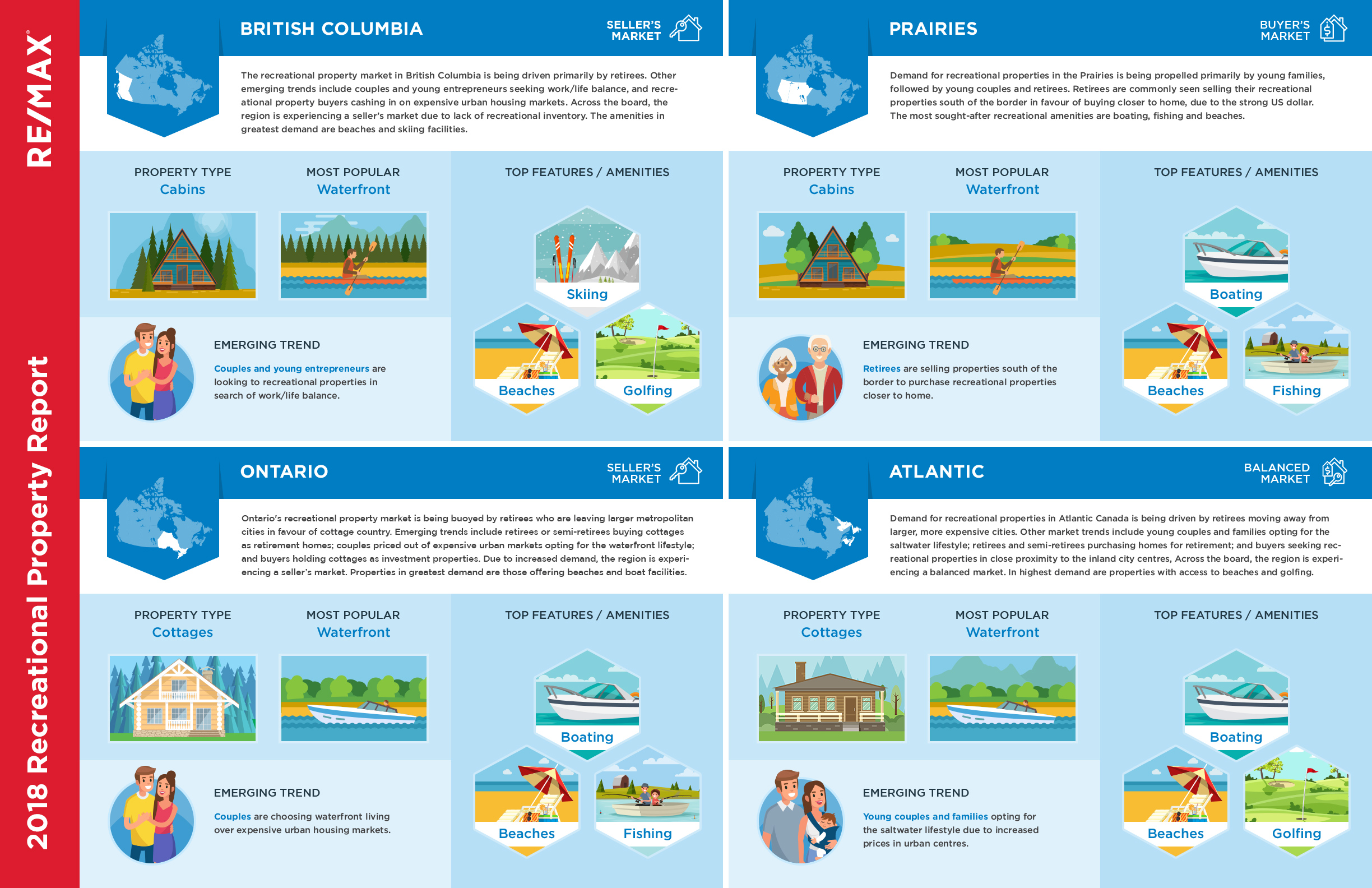

2018 Recreational Property Report

Source: http://blog.remax.ca/2018-remax-recreational-property-report/

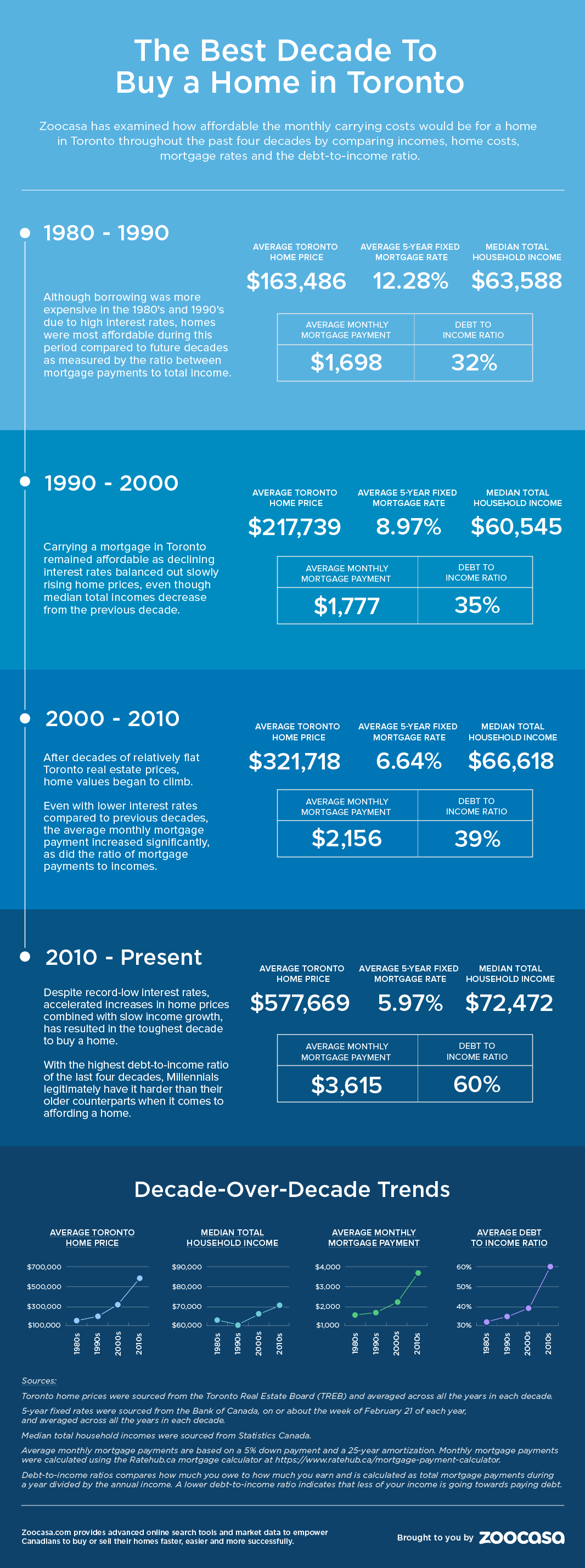

Boomers or millennials: Who had it tougher in the Toronto housing market?

Source: http://www.remonline.com/boomers-or-millennials-who-had-it-tougher-in-the-toronto-housing-market/

The plight of the millennial Toronto home buyer has been a turbulent one; for this generation, the search for the perfect abode has been defined by downsized expectations, sky-high prices and steep competition. While some chalk up millennial financial misfortune to spendthrift lifestyles and expensive taste, the fact is, according to Statistics Canada, two-thirds of Canadians within this age group still live within the family home.

Despite recent market softening, prices for condos, townhomes and houses for sale in Toronto remain exorbitantly expensive, presenting a hurdle to homeownership. According to the latest numbers from the Toronto Real Estate Board, the average home in the 416 fetched an average of $804,642. That’s factoring in a 12.4-per-cent year-over-year drop yet is still outside the realm of affordability for many.

However, long-term market observers can be less than sympathetic. Today’s home buyer enjoys some of the lowest borrowing costs in history, they point out, and earnings that are certainly higher than their ’80s counterparts. Boomers had to contend with interest rates in the high teens, after all, while Generation X faced a recession and dwindling employment prospects.

So, which generation has had the toughest time in Toronto’s housing market? To find out, Zoocasa did the math, assessing how the average home price, wage growth, rate of inflation and debt-servicing costs have changed. Check out how affordability has evolved over the decades in this infographic below.

The numbers paint a revealing picture. While the cost of borrowing was indeed in the high teens throughout the ’80s and ’90s, the relationship between median income and average home prices far outstrip any savings resulting from lower mortgage rates.

For starters, there’s the sheer increase in home prices over a 30-year period; in 1980, the average home could be had for $101,626, according to TREB numbers. Factoring in the era’s average mortgage rate of 12.8 per cent, and assuming a five-per-cent down payment and 25-year amortization, the average monthly mortgage payment in 1980 would be $1,698. That rose by a mere $79 (4.6 per cent) over the course of the next decade, with the average carrying cost hitting $1,777 in 1990. By the new millennium, that number had increased by $379 (21.3 per cent) to $2,156, before jumping $1,459 – a whopping 67 per cent – to $3,615 today.

Mortgage carrying costs have also more than doubled that of wage growth over the same period. According to Statistics Canada 2016 Canadian Census numbers, the median household income grew just 33 per cent from the 1980s to the 2010s, from $58,700 to $78,280.

Perhaps most telling is the proportion of debt mortgages now account for in the typical household expenditure. The average debt-to-income ratio, which can be used to determine how much debt is owed in relation to what is earned, has spiked alongside home prices. In 1980, mortgage-specific debt accounted for 32 per cent of this ratio. This increased marginally to 35 per cent in the ’90s, and to 38 per cent in the 2000s. However, following 2010, this ratio shoots up to 59 per cent, a strong indicator that debt loads have bloomed alongside home prices.

To put this in perspective, industry studies find a ratio over 49 per cent signals a struggle to pay down mortgage payments.

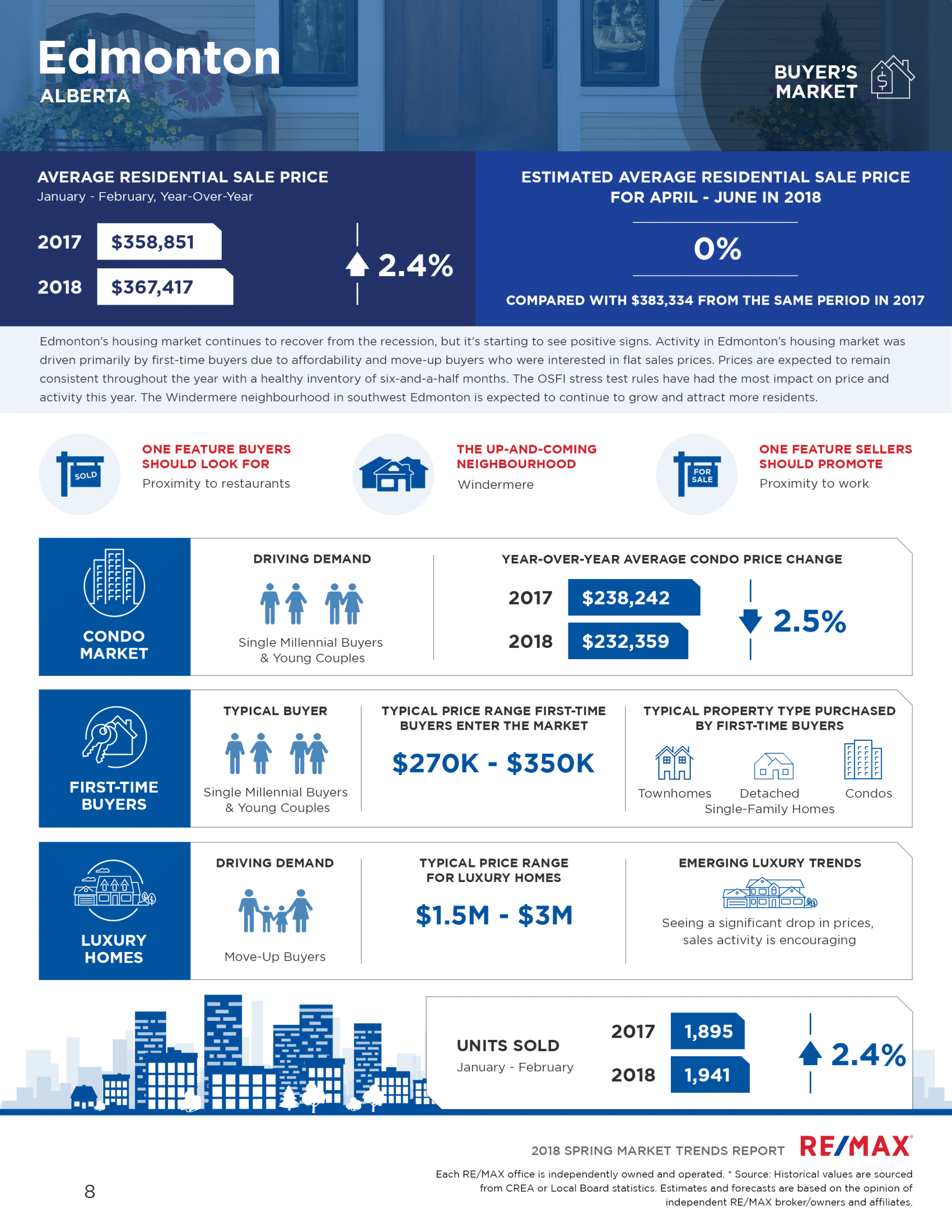

RE/MAX 2018 Spring Market Trends Report

Source: http://blog.remax.ca/remax-2018-spring-market-trends-report/#1481171191537-f67101ac-d5e8