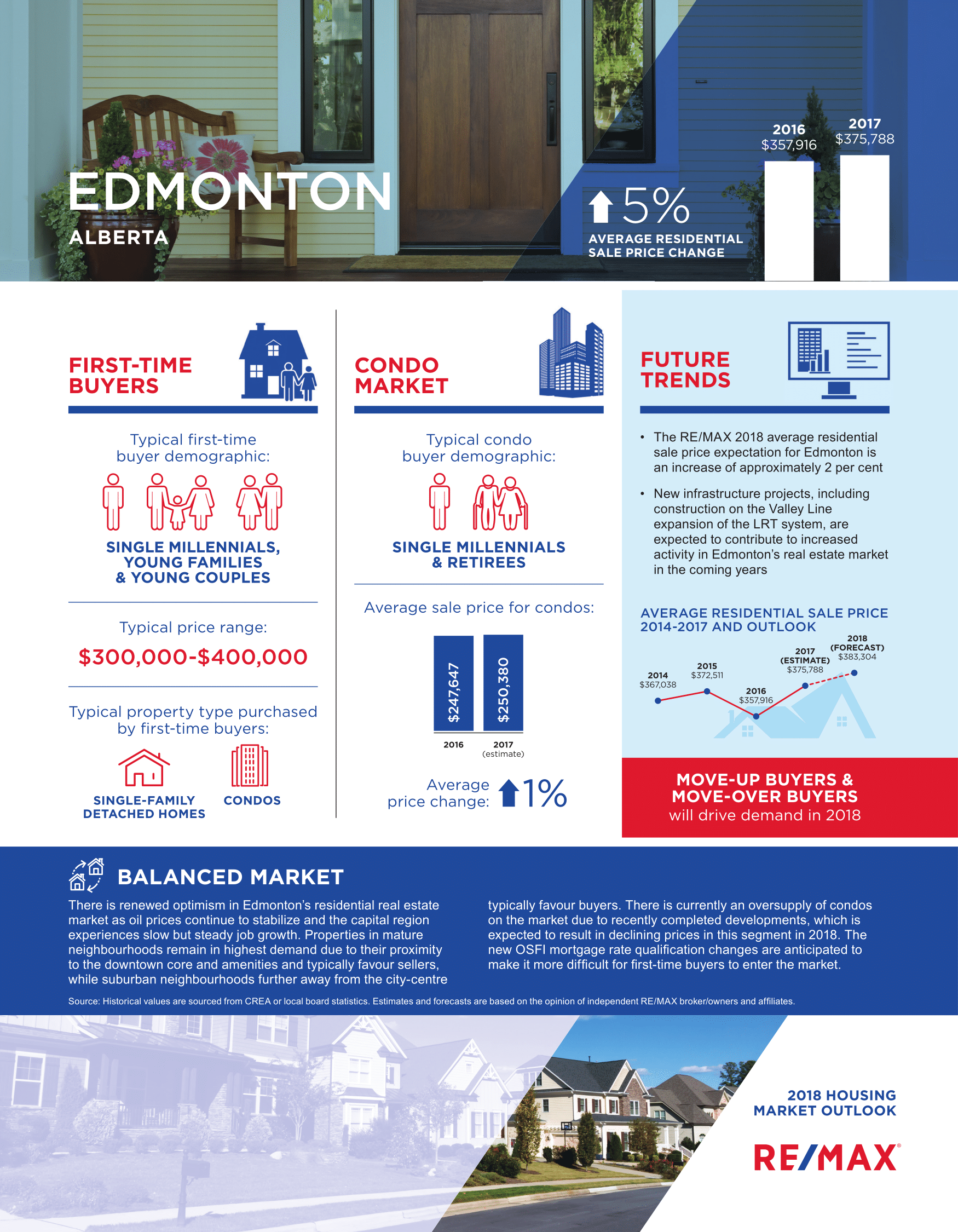

Source: http://blog.remax.ca/remax-2018-housing-market-outlook/#1481171191537-f67101ac-d5e8

RE/MAX 2018 Housing Market Outlook Report

YOU MAY BE TEMPTED TO GO WITHOUT A REALTOR – DON’T

New home shopping is an experience unlike any other. Stepping into a beautiful showhome where everything is new and clean and beautiful, without any clutter, it can seem like the perfect fit. Inside, you might be screaming out, “Yes! I am this colour coordinated and organized.” You want a new home. In fact, come to think of it, you need a new home.

After walking through the home dreaming about all the things you love and all the things you would change, you walk back down to the showhome office. “So, what did you think?” the salesperson asks. You profess your deep love for the home, and then it begins. They can hold that last walkout lot for you for 48 hours with a $500 cheque that they won’t cash, you agree, and then you embark on the long journey of decision-making and paperwork.

Everyone knows that the salesperson works for and represents the builder, but what does that really mean? Who represents you? Many people embark on this journey alone, trusting in the showhome staff to take good care of them. Some people even opt to save a few bucks using the builder’s lawyer for signing the documents. You are on your own from the beginning to the end, so what if something goes wrong?

Having a real estate professional along with you when purchasing your property is good for many reasons. To start, they are a neutral party that represents you, the buyer, while the showhome staff represent the builder. Most builders have cooperative commission structures in place to pay your representative, but have you ever stopped to wonder why this is a good idea? Over the years I have seen many reasons, here are a few:

NEGOTIATING CONTRACTS

Have you ever actually read through a builder’s contract? They are terribly long and very one-sided, leaving buyers at risk for things like having their house sold to someone who is offering a better price. It has happened before, and occasionally there is a requirement for conditions to be removed before the deadline, or the builder is going to sell to someone else.

REDUCING SALES PRESSURE

In general, people buy what they see in the showhomes. But have you ever wondered if you are getting the best deal? What will your decisions mean for resale? What upgrades add value to the house, and which just cost you money without any future return? Having a professional go with you to help you made these decision is paramount.

The sales team will always be working toward upselling, and they don’t care if your add-ons cost you thousands but give you a negative return, they just want to up that price. That is their job. While not every salesperson chooses their own numbers over integrity, it does happen all too frequently. Your real estate professional is there to look out for your best interests alone, and will help you navigate through all the sales pressure in making solid home-buying decisions.

SCORING A BETTER PRICE

While many showhome salespeople will say that you get a better price without an agent, it’s simply not true. Agents can assist you in negotiations, getting you a better price while still being paid for their efforts by the builder. And remember, that salesperson only makes money if you buy with them. Your agent makes money regardless of who you buy through, and can use their experience to shop around with different builders and negotiate a deal that will leave you smiling.

ASSISTANCE AFTER POSSESSION

Our office has well over 150 agents and we communicate with other offices regularly, selling our properties and discussing how to best represent our clients. If your builder tries to state things such as “the city isn’t issuing any more permits for grading this year” or you find yourself getting the runaround, if we don’t have the answers we know someone who does, and often leveraging the power of the more than 3,000 real estate agents can get answers.

So before you go looking at showhomes, sit down with your favourite agent. It helps to bring them along, and they need to register you with the showhome to allow them to represent you. When it is all said and done, you will be glad you did.

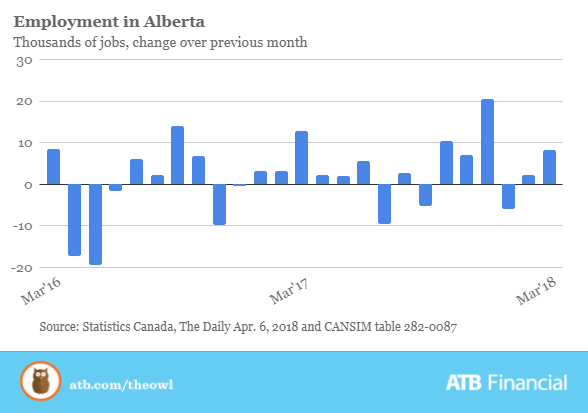

Slow but steady improvements in the job market

Source: https://mailchi.mp/aa76eea92fde/the-owl-slow-but-steady-improvements-in-the-job-market?e=6f1f3fb3a5

It may not be the bonanza of new jobs that a lot of Albertans had become used to in the first half of the decade, but the employment situation in our province continues to improve gradually.

A net 8,300 jobs were added in March, following a more modest increase of 2,300 in February. However, all of the jobs added last month were part-time. The unemployment rate provincially dropped to 6.3 per cent–the lowest since the summer of 2015. Much of that decrease was due to a drop in the overall labour force (that is, fewer people were looking for work).

The longer-term view is always the more appropriate one, and in this respect the news is positive. Over the last 12 months, Alberta created 46,400 full-time jobs, an increase of 2.5 per cent. New job creation has been strongest in manufacturing (+15,000), oil and gas (+14,200) and business support services (+5,500).

Jobs in the government sector have not been a major contributor (+3,600), and two sectors which had previously seen the strongest gains during the recession–health care and education–have been essentially flat over the last year.

Calgary’s unemployment rate popped back to 8.2 per cent in March, up three-tenths of a percentage point from February. There was some slight decline in total jobs (-1,600), but also an increase in the labour force (+1,300), suggesting that either previously discouraged job seekers are back looking for work, or people are moving to the city.

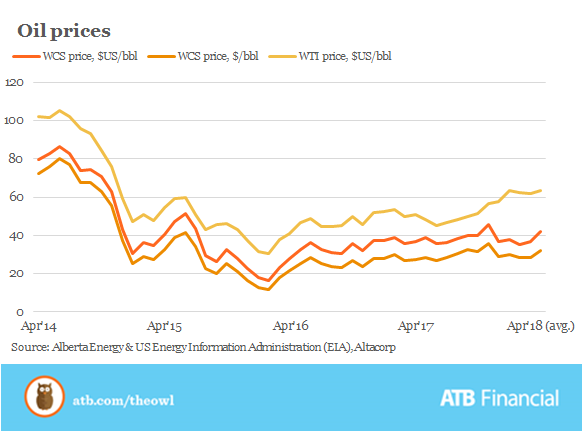

Oil prices warming up

Source: https://mailchi.mp/986382aa0e63/the-owl-oil-prices-warming-up?e=6f1f3fb3a5

With temperatures still below zero and plenty of snow on the ground, it may feel like it’s not heating up, right? The good news is that it is, at least when it comes to oil prices.

The price of North America’s benchmark price for oil (West Texas Intermediate) currently sits around $US 65 per barrel, that’s 25 per cent higher than during the same time last year. The last time oil prices were this high was back at the beginning of 2014 when Alberta’s economy was growing at a rate of nearly five per cent.

Throughout 2015-2017, prices were stuck around $US 50 per barrel (WTI). Higher US production levels were a significant factor in this–but it is changing. Supply levels are on the decline and global demand for crude oil is intensifying and causing prices to push higher.

There is more good news, too.

At the start of 2018, the Canadian benchmark price for oil, Western Canadian Select (WCS) (the price Alberta producers receive) had not improved at all from last year. Canadian pricing was thought to be held back by pipeline bottlenecks. However, over the first three months of the year, this changed. Compared to January, WCS prices are now 13 per cent higher and currently sit around $US 44. The price improvement from the beginning of the year is due to higher demand for cheaper WCS blend. Prices have also improved on the back of the latest victory regarding the Trans Mountain pipeline expansion project.

Higher oil prices are good news for Alberta for several reasons. Improved energy prices will help provide expansions to capital spending programs in the province. They will also alleviate some of the problems Alberta’s labour market is still encountering from the 2015-16 downturn. When it comes to oil prices, the forecast at this point looks warmer.

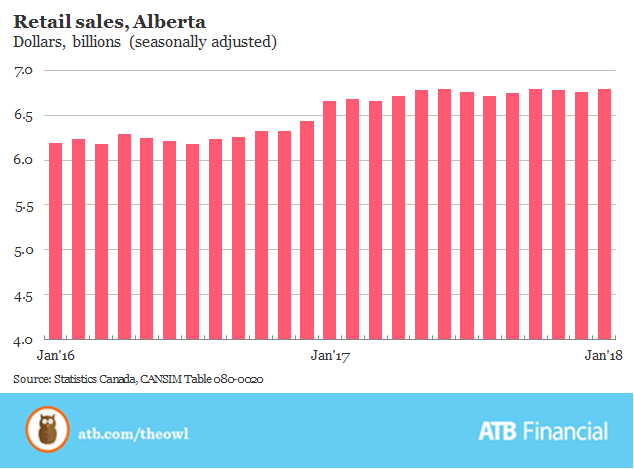

Retail sales start 2018 on a record high

Source: https://mailchi.mp/f320db705863/the-owl-retail-sales-start-2018-on-a-record-high?e=6f1f3fb3a5

Albertans’ debit and credit cards were a bit busier in January as retail sales reached a record high in the province. Total sales reached $6.8 billion to start the year—this number is adjusted for seasonality. Compared to the beginning of 2017, sales were 2.1 per cent higher at the start of 2018.

In per capita terms, Albertans outspent the rest of the country at malls and gas stations by an average of $224 per month in January. This difference can be explained by a number of elements like a higher employment rate and higher incomes. The difference also accentuates the strength of the provincial economy, even after a significant recessionary period.

The fact that retail sales have started the year on a record high is proof the recession of 2015/16 is well behind us. However, our province may experience some pullback in spending as the year progresses. This could be due to a couple of factors. First, the provincial unemployment rate is expected to come down only gradually. Many Albertans may still be without work which could affect spending. Second, with higher interest rates and mounting household debt, consumers could react by spending less. As a result, sales growth will likely begin to slow.

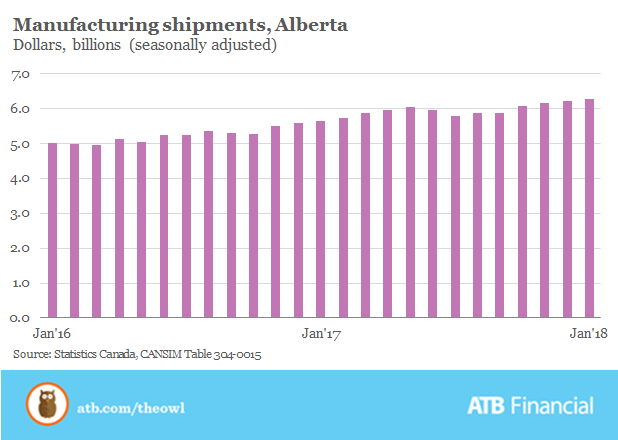

Manufacturing finds its groove

Source: https://mailchi.mp/f62d4f673bfb/the-owl-manufacturing-finds-its-groove?e=6f1f3fb3a5

For the first time in a little more than three years, sales from Alberta factories and shop floors have reached pre-recession highs. In January, total manufacturing shipments grew 1.1 per cent from December and reached $6.3 billion. Compared to January of last year, manufacturing shipments were up more than 11 per cent.

Sales gains were recorded in about half of all of manufacturing’s sub-sectors. Transportation equipment manufacturing came out on top with shipments in this category growing seven per cent from the end of last year. In a sign that Alberta’s energy industry is growing, significant sales gains were seen in chemical (+6.4 per cent), petroleum (+5.4 per cent) and fabricated metal manufacturing (+4.7 per cent).

The province’s manufacturing sector is starting the new year with some real momentum. Shipments in almost every sub-sector of manufacturing remain well above the previous year’s levels. Much of the momentum has to do with the stabilization and resurgence of Alberta’s energy sector. For example, petroleum manufacturing is up more than 15 per cent year-over-year, and sales of manufactured machinery are up by close to 26 per cent.

As economic conditions continue to improve and as Alberta’s energy sector continues to rally, manufacturing as a whole will help stimulate our province’s economic growth.

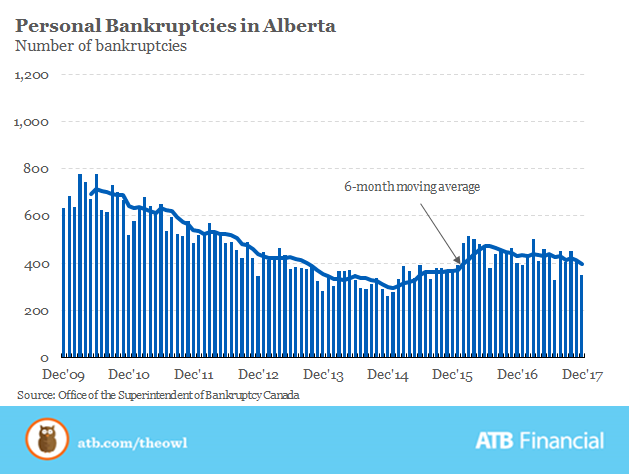

Consumer bankruptcies begin to fall again

Source: ATB’s “The Owl” Email Newsletter: https://mailchi.mp/195ed4ce3e82/the-owl-consumer-bankruptcies-begin-to-fall-again?e=6f1f3fb3a5

Albertans have reason to feel optimistic about the economy in early 2018. Oil prices have firmed up, the labour market continues to improve and, now, personal bankruptcies are on the decline.

According to the latest statistics, insolvencies in the province fell to 350 (-10.4 per cent) in December, 53 lower than one month earlier. Compared to the previous December, when bankruptcies reached 401, the number of personal bankruptcies in Alberta is down by a little more than 13 per cent.

Throughout last year, consumer bankruptcies were on the decline. They picked up again in late-summer and autumn, in part because of increasing borrowing costs. The Bank of Canada increased its key interest rate in July and September, which made lending slightly more expensive for both consumers and businesses.

The Bank of Canada increased its key lending rate again at the beginning of this year with another announcement set for March 7th. Three rate increases in an eighth month window and the uncertain fate of Canada’s trade picture make it unlikely that consumers will face another rate increase this month. Given this and the economic recovery taking place in the province, consumer bankruptcies will likely level off or continue to drop.

2018 housing outlook mixed for Prairie market

Source: http://www.westerninvestor.com/news/alberta/2018-housing-outlook-mixed-for-prairie-market-1.23105838

The short-term future of the residential sector in the Prairies is a tale of four cities – slow and steady in Winnipeg, a reversal of a two-year slide in Calgary and Edmonton and another year of declines in Saskatoon.

Though GDP growth, employment and immigration fundamentals are slowly improving, industry players aren’t getting too far ahead of themselves. Caution is the word of the day.

Or if you live in Winnipeg, it’s boring, but in a good way.

Winnipeg

Winnipeg’s resale housing market has experienced 18 consecutive years of price increases and there’s a very good chance this year will break 2016’s record-setting performance, said Peter Squire, residential market analyst for the Winnipeg Realtors Association. “We’re like a GIC. We keep moving along, self-assured,” he said.

Lai Sing Louie, Calgary-based regional economist for Canada Mortgage and Housing Corp. (CMHC), said there’s nothing wrong with boring in real estate. Winnipeg’s apartment vacancy rates have been unwavering in the 3 per cent range, rents have increased and home resale prices have been rising steadily, if not spectacularly.

“I can’t remember the last time prices decreased in Winnipeg. It’s been decades,” Louie said, adding CMHC believes prices will rise about 2 per cent annually in 2017 and 2018, remaining close to the $285,000 level.

The seemingly never-ending conversion of heritage buildings into condominiums, and the new condo buildings emerging on the city’s skyline, are luring unprecedented numbers of people into Winnipeg’s downtown. Over the last five years, the number of downtown residents has grown by 7 per cent to nearly 17,000.

Dollar volumes through 10 months of this year have already exceeded last year’s totals, and Squire believes the outlook contains further good news.

“Our unemployment rate and job creation are among the best in the country. It’s a combination of jobs plus affordability [of homes]. Plus, there’s more security on the job side because our economy is so diversified. We don’t see huge layoffs in any one industry. A diversified economy – government, manufacturing, financial services, aerospace and food processing – helps instil consumer confidence,” Louie said.

Manitoba’s provincial nominee program – which facilitates immigration of skilled tradespeople and business people from all over the world – has been a “huge” factor in boosting the population, which also helps drive the housing market. At last count, more than 130,000 people have found new lives in Manitoba over the last decade.

“We’ve also seen some people who had moved to Alberta and Saskatchewan come back to Manitoba, which has also helped,” Squire said.

Edmonton

With an expected 10 per cent increase in home sales this year, Edmonton qualifies as the hottest market on the Prairies. About 18,800 homes are forecast to change hands in 2017, up from 16,990 last year. Yet despite these

relatively lofty projections, Louie said the city isn’t out of the woods yet.

“It’s a strong rebound but a lot of people are worried about their jobs. They’re still coming out of the recession in Alberta. They’re getting growth but it’s from a low level,” he said.

The number of new listings in Edmonton has increased along with improving sales, reaching levels not seen since 2008. Resale home prices were up 3.5 per cent on a year-over-year basis through the fall, but CMHC attributes much of this to the sale of a large proportion of homes at the higher end of the spectrum.

One significant challenge for the city’s housing sector is the increasing number of people moving out of the city to other provinces.

“Traditionally Alberta gains people from other parts of Canada but due to the difficult job environment, it’s slowing the number of people coming to Edmonton. But our sense is the worst is over and markets in Alberta are going to start to firm up over the next two years,” Louie said.

Calgary

Calgary is still reeling from the downturn in the oil and gas sector a couple of years ago. With less job security and lower income came fewer house sales.

“Oil prices dropping was a punishing blow to the [housing] market,” Louie said. Housing sales plunged 29 per cent in a single year, he noted.

As the economy starts to creep back, housing sales are forecast to increase by 6 per cent in 2018. It’s all a far cry from 2006, when house prices in Calgary skyrocketed 38 per cent.

“We expect prices to rise in 2019 but in the low single-digit range. We won’t be seeing the days when prices were going up by more than 30 per cent,” he said.

White-collar job creation is crucial to kick-starting Calgary’s home sales, and the faster office space in the city fills up, the quicker the housing market will pick up, he said.

“Office vacancy rates are still about 25 to 30 per cent. One in four buildings is empty,” Louie said.

Saskatoon

The oil and gas sector slump has also dragged down Saskatoon’s market, which was exacerbated when potash and uranium values also declined.

Saskatoon has now slipped into a buyer’s-market . There’s more supply than demand so it’s putting some downward pressure on price. CMHC is now expecting a 2 per cent drop in average home prices this year.

There are signs that the job market is improving and the province’s economy is starting to expand again, so Louie expects a slow transition to more balanced market conditions next year.

“There won’t be a lot of upward price pressure. We predict prices will stabilize. We’re looking at flat price growth next year,” he said.

Projected sharp gains in population will boost demand for rental properties over the next two years,but the addition of more than 630 apartments during the past 15 months may mean the vacancy rate would drop only slightly and remain near current highs of about 10 per cent. A decade ago, the vacancy rate was below 1 per cent.

The provincial forecasts could all be thrown out of whack with another shock to the economy, analysts warn.

Louie said perhaps the biggest wild-card is the U.S. Trump administration threat to scuttle the North American Free Trade Agreement. That would have serious repercussions right across the Prairies.

China-Alaska deal chills outlook for B.C. LNG projects

Source: http://www.westerninvestor.com/news/british-columbia/china-alaska-deal-chills-outlook-for-b-c-lng-projects-1.23105849

Just three and a half months after Petronas and its partners pulled the plug on a $36 billion liquefied natural gas project in B.C., one of the partners has reappeared in Alaska.

And what Sinopec has planned for Alaska could blow B.C.’s LNG ambitions right out of the water, according to one industry analyst, because it could sew up the market in China for LNG that B.C. projects were hoping to capture.

On November 8, Alaska Gasline Development Corp. – a state-owned entity – announced a joint development agreement that would see Chinese companies and banks partnering in a US$43 billion LNG project in Alaska.

The Chinese partners include China Petrochemical Corp. (Sinopec), which held a 15 per cent stake in the now-dead Petronas-led Pacific NorthWest LNG project.

The financing partners include the China Investment Corp. and the Bank of China.

The project also has the backing of the Alaskan government, which would have a 25 per cent stake in the project throughits Alaska Gasline Development Corp. (AGDC), which has been granted a generous tax incentive.

“[Alaska] has taken an equity stake,” said Jihad Traya, manager of natural gas consulting for Solomon Associates. “It takes away all that agency issue and all that other discussion around LNG taxes and fiscal certainty. You’ve now created fiscal certainty.”

So not only does the project have the financial backing of one of the world’s biggest banks, and a government equity partner, it also has all of the advantages B.C. boasted.

Those advantages include an ocean of gas in northeast B.C., short shipping distances to Asia and a cold climate, which reduces the energy input costs for chilling natural gas to minus 160 Celsius.

The B.C. advantage does not appear to be sufficient to keep major energy players interested in B.C. Two months after Petronas announced it was pulling the plug on its LNG project in Prince Rupert, Nexen, owned by China’s CNOOC Ltd. called a halt to its Aurora LNG plant on Digby Island.

Blake Shaffer, of the University of Calgary’s department of economics, said the new China-Alaska agreement is far from a done deal. It is not much more than a memorandum of understanding, he said.

Although Alaska has some of B.C.’s advantages, he said the project’s costs would be much higher than any in B.C.

The Alaska LNG project would require a 1,200-kilometre pipeline to bring natural gas from Alaska’s North Slope to a three-train LNG plant in Nikiski on Cook Inlet.

Building the pipeline would be costly due to the higher costs of working in the remote north and the lack of ancillary infrastructure, such as roads that would need to be built, and which B.C. already has, Shaffer noted.

Traya disagrees. He said he expects the pipeline would be built with Chinese steel, which would reduce the costs.

“I can assure you that the need for U.S.-made steel for this project is not going to matter,” he said. “It’s going to be all Chinese steel, valves and engineering.”

The U.S. Energy Information Administration(EIA) predicts China will account for more than a quarter of the global growth in LNG demand out to 2040.

Changes coming for Alberta condo developers

Source: http://www.westerninvestor.com/news/alberta/changes-coming-for-alberta-condo-developers-1.23105762

Alberta condominium developers will have to provide buyers with “firm move-in dates” and hold buyer deposits in trusts while units are being built, under a rework of the Condominium Property Act by the provincial government.

The province plans to roll out the Condominium Property Amendment Act starting in January 2018.

Developers will also be required to provide realistic estimates of condo fees under the act, which gives the government increased power to investigate developers and impose fines if rules are broken.

As well, age restrictions on most condo and apartment buildings could soon be abolished under separate legislation tabled last month.

The changes were part of the Alberta Human Rights Amendment Act, 2017. If approved, adult-only buildings would become either seniors-only or family-friendly complexes.

James Mabey, chair of the Realtors Association of Edmonton and a real estate professional with Century 21 Masters in St. Albert, said the changes will put more housing options on the market.

“There’ll be a broadening of the market, just in terms of people being able to look at these properties,” he said. “Right now some people who are looking to buy a unit can’t because of the restrictions.”

Mabey said lifting the age restriction will not only increase sales in condo complexes, but also make purchasing a condo unit more affordable.

Currently, Canada Mortgage and Housing Corp. won’t approve mortgage insurance to any unit that’s in a building with age restrictions.

If the Alberta Human Rights Amendment Act 2017 passes third reading, changes will take effect in two stages starting January 1, 2018.

The first stage would stop landlords in apartment buildings from discriminating on age.•

New mortgage rules coming January 1, including stress test

Source: http://www.cbc.ca/news/business/osfi-mortgage-rules-1.4358048

Previously only those with less than 20% down were tested, but now all borrowers will be.

Canada’s top banking regulator has published the final version of its new mortgage rules, which include a requirement to “stress test” borrowers with uninsured loans to ensure they could withstand higher interest rates.

The Office of the Superintendent of Financial Institutions (OSFI) released new guidelines for the mortgage industry on Tuesday. The regulator floated a similar version of these rules earlier this summer in draft form, but Tuesday’s release makes them official as of Jan. 1.

Among the major new rules is a requirement to stress test uninsured borrowers. Previously, only insured borrowers had to undergo such a test.

By law, borrowers with a down payment of under 20 per cent for a home must purchase mortgage insurance. Borrowers pay an insurance premium, but the beneficiary is actually the lender, because the insurance protects the loan giver in the event the borrower defaults on the loan.

And the insurance premiums can easily be into the thousands of dollars, on top of the cost of a home, ranging from 0.6 to 4.5 per cent of the mortgage, depending on the size of the down payment and the price of the property.

The Canada Mortgage and Housing Corporation is far and away the biggest mortgage insurer in Canada, although it competes with private rivals Genworth Financial, Canada Guaranty and a few others.

On a $500,000 home with a $50,000 down payment, the CMHC says a borrower would be charged an extra $13,950 to insure the $450,000 mortgage.

The vast majority of first-time borrowers have to purchase mortgage insurance, and they have been obligated to undergo a stress test of their finances since last year.

Anyone who puts down more than 20 per cent of the value of a home doesn’t have to pay such insurance, and is known as an “uninsured” borrower — the people affected by the new rules revealed October 17.

The stress test itself consists of ensuring the borrower would be able to pay the loan if interest rates become higher than they are today.

According to the Bank of Canada, the big banks currently have an average five-year posted mortgage rate of 4.89 per cent. But it’s not difficult to find a lower rate by shopping around. (Rate comparison website ratesupermarket.ca calculates that many lenders are offering five-year mortgages below three per cent, as does rival RateSpy.com and many others.)

The stress test is designed to simulate a borrower’s financial situation by assuming they would have to pay back the loan at the posted average — not whatever deal they were able to negotiate. So under OSFI’s new rules, borrowers would be stress tested at either the five-year average posted rate, or two per cent higher than their actual mortgage rate — whichever one is higher.

Notably, the new stress test rules won’t apply to mortgage renewals as long as they are with the borrower’s existing lender.

The regulator published a draft of its new rules over the summer, before consulting with stakeholders about any changes that need to be made. The regulator said it received more than 200 submissions from people in the industry and members of the public about the rules as they were proposed in July.

The idea’s critics, including many in the real estate industry, said imposing a stress test on all buyers would put a chill on the housing market at a time that it can ill afford it.

But OSFI is pressing ahead anyway with changes it describes as “vigilant.”

“These revisions reinforce a strong and prudent regulatory regime for residential mortgage underwriting in Canada,” said Jeremy Rudin, OSFI’s superintendent.

TD Bank economist Brian DePratto agrees with that assessment, noting “on balance, these changes should help enhance the resilience of the Canadian banking system in a rising interest rate environment.”

But that’s not to suggest there won’t be pain to be had because of them. DePratto estimates that expanding the stress test to all buyers will depress demand for housing by about five or 10 per cent, and there may be a mini-rush to get in before the new rules come in in January.

He believes the housing market’s reaction to the last stress test rules in 2016 are a good example of why the regulator felt compelled to act again: As of August, insured mortgages were down 4.5 per cent in the 12 months since they were subject to a stress test.

Uninsured mortgages, meanwhile, grew 17.3 per cent — which suggests homeowners were doing anything they could to get their down payments above the 20 per cent threshold, and away from being locked out of an insured mortgage from failing a stress test.

“Estimates peg the uninsured market at roughly 80 per cent of activity recently, so this measure will bite, arguably more than past changes in the priciest markets,” Bank of Montreal economist Doug Porter said.

In practical terms, the stress test would mean that a potential buyer of a $1 million home with 20 per cent down would see their purchasing power knocked down by about 15 per cent, he estimated.

“These changes in mortgage rules represent a further tightening of the screws for the housing market.”

Mortgage broker Kim Gibbons with Mortgage Intelligence said she thinks the new rules are a little too strict.

“In the mortgage world, a lot of people are talking about how it’s too stringent and the government is tightening up far too much, considering what the delinquencies are in this country for mortgages,” she said in an interview.

“And I know that they want to cool the market, but this might put a halt on it.”

“I think it’s going to be a busy November and December. And I think after that, it’s going to cool the market a bit,” she said.

In addition to the stress test, the new rules would require lenders to have more scrutiny around the loan-to-value ratio of the loans they give out, to ensure they are not giving out mortgages that are too large compared to the underlying value of the home.

There’s also new limitations on so-called co-lending or bundled mortgages that aim to ensure lenders don’t flout rules designed to limit how much they can lend.

St.Albert Gazette Feature on Don Cholak

I am very proud of this feature in today’s issue of the St. Albert Gazette. Thank you to all of my past & current clients.

I hope you enjoy the read. When you are ready, I would love to help you buy or sell your home or commercial property!

Call/Text me directly at 780-718-8400 to buy, sell, or simply talk real estate!

Spring Maintenance

Spring’s the perfect time for taking care of outdoor maintenance!

The arrival of warm weather signals fun in the backyard with friends and family. The last thing you want to deal with are unexpected home repairs so here’s a list to help keep you on track:

1. Clear away debris and dead foliage from any flowerbeds.

2. Inspect hose connections to ensure there are no leaks.

3. Replace damaged window screens and any weather stripping.

4. Clean your fireplace and/or wood-burning stove and flue.

5. Make sure your lawn mower, weed wacker and other tools are in good working order.

6. Clean and repair your patio furniture and inspect your deck for loose or rotten boards.

7. Trim back shrubs and vines that are growing near your air conditioning unit and dryer vent.

8. Inspect and clean your gutters and make sure downspouts drain away from your foundation.

9. Patch up any cracks you find around foundation and driveways before they spread further.

10. Inspect your roof for cracked or missing shingles and trim branches that hang over the top of your roof.

Proactive home maintenance helps prevent small issues from getting out of hand. Your home is a huge investment and minimizing repair bills will help you realize your highest rate of return. When you’re done, you’ll be able to relax and enjoy the lazy days of summer knowing that everything’s been taken care of!

Source: Pillar to Post Newsletter (https://www.pillartopost.com/Marchpostnotes2017#choices)

Pets and Condo Living

WHY ARE PETS AN ISSUE?

There are many reasons for a condominium to have rules regarding pets. For example:

– Buildings with shared air flow systems can have problems with pets for occupants with allergies.

– Pets can disturb fellow occupants with noise, damage common property with digging, scratching or chewing fences and killing grass, etc. All owners pay for maintenance of common property, even those with no pets.

– Pets in a building can impact a sale. Buyers either want pets or no pets.

– The type of pet allowed in the condo needs consideration as there are shared spaces that escaping pets could access.

– Pets are family to many people.

HOW DO I KNOW IF PETS ARE PERMITTED IN A CONDO?

– The bylaws of the condominium will detail the requirements for pet approval, define the type, number and possibly size or breed of pet that will be approved.

– Bylaws will prescribe the remedy for a problematic pet, the requirements for a deposit (if any), and any requirements for registration, vaccinations, Municipal Licensing, photos, etc.

HOW TO OBTAIN APPROVAL FOR A PET?

– Contact the property manager or if there is no management company, contact the Board contact for the required application forms and criteria.

BYLAWS APPLY TO YOUR PET

– Bylaws are enforceable as written.

– The bylaws vary from one condo to the other, never assume you know the pet bylaw.

– Obtain pet approval before you waive sale conditions.

Source: Condo Check email newsletter, www.condo-check.com

Radon: Why it Matters

WHY TEST FOR RADON? WHAT YOU NEED TO KNOW

Any home can have a radon problem – old or new homes, well-sealed or drafty homes, homes with or without basements. It is estimated that nearly 1 in 15 homes in the U.S. and Canada has an elevated level of radon. Prolonged exposure to unsafe levels of radon can create an increased risk of lung cancer; in fact, radon is the second leading cause of lung cancer after smoking. Lung cancer caused by avoidable radon exposure is preventable, but only if radon issues are detected and mitigated prior to prolonged exposure in homes and buildings. There is real risk in not knowing if a home has a high level of radon.

WHAT IS RADON?

Radon is a naturally occurring odorless, colorless, radioactive gas formed by the ongoing decay of uranium in soil, rocks, sediments, and even well or ground water. While radon that escapes into the atmosphere is not harmful, dangerously high concentrations can build up indoors, exposing residents to possible health risks.

HOW DOES RADON GET INTO A HOME?

Radon can migrate into the home in several ways. Openings or cracks in basement walls, foundations or floors are common avenues. Sumps, basement drains, and spaces between gas or water fittings can also allow radon into the structure. Other entry points can include gaps in suspended floors and cavities within walls.

HOW CAN I MAKE SURE I’M NOT AT RISK?

Homeowners are encouraged to request that radon testing be added the home inspection process. If an elevated level of radon is detected, steps can be taken to reduce the concentration to or below acceptable levels inside virtually any home. This can include a relatively simple setup such as a collection system with a radon vent pipe, which prevents radon from entering the home in the first place. Professional mitigation services can provide recommendations for a home’s specific conditions.

Source: Pillar to Post e-Newsletter

Ferns Detox Indoor Air

Want to improve the air quality in your home? Decorate with ferns. Horticulture experts say potted ferns help purify indoor air by filtering out common household pollutants.

Here’s how to keep your family breathing easier:

1. Pick your plant. There are many types of ferns, but these easy-to-find varieties do well indoors. If you would like a tall fern, try the bird’s-nest. Prefer a plant potted in a hanging basket? The Boston fern is best. For a plant that fits in small spaces, the little button fern is perfect.

2. Water often. Ferns are thirsty plants, so it is a good idea to keep them consistently watered, making sure the soil stays moist – but not wet.

3. Add humidity. Ferns thrive in normal house temperatures and indirect light. To up humidity for ferns, double-pot your plants in a set of plastic containers, filling the area between them with pea gravel. Keep the gravel moist, and your plants will be good to grow.

Source: Pillar to Post Newsletter // https://www.pillartopost.com/Novemberpostnotes2016#choices

Garage Door Safety

Overhead garage doors may be the largest moving object in most homes and can weigh up to 400 pounds. For safety, homeowners should be sure that it’s up to date and kept in proper working order.

Older garage doors often lack some of the safety features required in newer installations. These include spring systems designed to prevent flying metal in case of spring failure, and automatic openers that can operate in reverse if the door closes onto an obstacle. Automatic openers must also have sensors, usually a pair of electric eyes, that will stop and reverse the door if a person or pet moves across its path. It is sometimes possible to retrofit existing systems to include these sensors without replacing the entire system. Children should be taught that the garage doors are dangerous, and that toys, bikes, etc. should never be left in the way.

There is also the issue of power outages and how to get the door open. For several decades, automatic openers have featured an emergency release that will disengage the opener, allowing the door to be opened by hand. In most cases it will be a short red cord that hangs down close to the center of the door, inside the garage. Homeowners should learn in advance how to operate the release in case they need to get a car out of the garage during a power outage.

Maintaining the door is important for safety and for quiet, smooth operation. A garage door specialist can provide periodic maintenance, or homeowners can do much of this themselves including lubricating the springs and hinges. The track itself, where the wheel run, should never be lubricated for safety reasons. A professional can also check the door balance and alignment and make any needed adjustments.

When moving into a home, the new owners should change the remote control code immediately for security purposes, just as they would re-key or change the home’s door locks. If the remote is not reprogrammable, chances are it’s an outdated system and should be upgraded for safety reasons. A garage door and opener, with proper maintenance, will help ensure safe operation and should last for many trouble-free years.

Source: Pillar to Post e-Newsletter

Fall Home Maintenance

The days are getting noticeably shorter, and maybe there’s a nip in the air – fall is definitely on its way. Now is the perfect time to get your home in shape before winter rolls in, while the weather is still pleasant enough for spending time outdoors.

Seal it up: Caulk and seal around exterior door and window frames. Look for gaps where pipes or wiring enter the home and caulk those as well. Not only does heat escape from these openings, but water can enter and may eventually cause structural damage and mold problems.

Look up: Check the roof for missing or damaged shingles. Winter weather can cause serious damage to a vulnerable roof, leading to a greater chance of further damage inside the home. Although you should always have a qualified professional inspect and repair the roof, you can do a preliminary survey from the ground using binoculars.

Clear it out: Clear gutters and eaves troughs of leaves, sticks, and other debris. Consider installing leaf guards if your gutters can accommodate them – they are real time savers and can prevent damage from clogged gutters. Check the joints between sections of gutter, as well as between the gutter and downspouts, and make any necessary adjustments or repairs.

No hose: In climates with freezing weather, drain garden hoses and store them indoors to protect them from the elements. Shut off outdoor faucets and make sure exterior pipes are drained of water. Faucets and pipes can easily freeze and burst, causing leaks and potentially serious water damage.

Warm up time: Have the furnace inspected to ensure it’s safe and in good working order. Most utility companies will provide no-cost inspections, but there can often be a long waiting list come fall and winter. Replace disposable furnace air filters or clean the permanent type according to the manufacturer’s instructions. Using a clean filter will help the furnace run more efficiently, saving you money and energy.

Light that fire: If you enjoy the crackle of a wood-burning fireplace on a chilly fall evening, have the firebox and chimney professionally cleaned before using it this season. Creosote, a byproduct of wood burning, can build up to dangerous levels and cause a serious chimney fire if not removed.

Article courtesy of Pillar to Post e-newsletter.

COMING SOON!

COMING SOON! A new BANK FORECLOSURE in a fabulous location! Do you know someone looking for a great buy on a 3+1 bedroom single family home in Woodlands? Please email don@doncholak.com or call/text 780-718-8400 to request a viewing today!

2016 Real Estate Forecast

The REALTORS® Association of Edmonton released their annual housing forecast today at a seminar at the Northlands Expo Centre attended by 700 REALTORS® and business leaders. Chair Steve Sedgwick forecast that sales of residential homes in the Edmonton Census Metropolitan Area will remain relatively stable. A decline of about 2.3% from 2015 sales levels will result in less than 17,000 sales in 2016.

Edmonton CMA had a good year last year with all residential sales at 17,298. That is down 9% from 2014 but up over 1% from 2013. Sedgwick expects another solid year in sales of single family homes in the Edmonton area but with a small decrease of about 2.5%, as economic uncertainty continues. “The continuation of low oil prices and economic decline have made buyers cautious. While much of the decline is offset by record low lending rates, we don’t expect sales to pick up without a boost in our overall economy. That said, Edmonton has fared much better than many other places in Alberta. We expect continued growth and development in our city to continue to keep interest in our housing market strong.” explains Sedgwick.

Condo sales are expected to decline by a modest 2.7% throughout the region as the rental market eases up and migration slows down. The popular duplex/rowhouse category was strong in 2015 and looks to remain so through 2016 as more inventory comes available in this category. Duplex/rowhouses offer both affordability and an ownership model that appeals to many first time buyers.

Prices, as usual, will fluctuate through the year but the 12-month average price for a single family detached property is anticipated to decrease modestly about 2.7% as inventory grows. Condominium property average prices are projected to decrease at the same rate with many higher priced options keeping the average price inflated.

Sedgwick’s forecast was supported by four other speakers at the seminar including Todd Hirsch, Chief Economist, ATB Financial; John Rose, Chief Economist, City of Edmonton; Bruce Edgelow, VP of Strategic Initiatives, ATB Financial; and Christina Butchart, Senior Marketing Analyst Canadian Mortgage and Housing Corporation.

There are 3,300 REALTORS® operating in the greater Edmonton area which extends as far as Cold Lake, Wetaskiwin, Drayton Valley, Vegreville and Westlock.

A recent article in the Edmonton Journal stated that “Edmonton resale home prices will soften and sales will slide rufther in 2016 – but not as much as other places in Alberta battered by a faltering economy, says a forecast by the Realtors Association of Edmonton. ‘Edmonton and area has not felt the same effects of oil prices as the rest of Alberta has,’ Steve Sedgwick said Wednesday. ‘There’s a lot of exciting growth happening in Edmonton and we remain conservatively optimistic when it comes to our housing market.’

It’s an assessment backed by prominent economists, who say that Edmonton’s economy will slow in 2016, but not as much as other Alberta municipalities.

‘While you’re going to continue to see some very negative numbers and some very negative commentary about the province as a whole, people have to bear in mind that Edmonton is a bit of an island in the storm,’ said John Rose, chief economist for the City of Edmonton. Rose predicts a growth of 0.5 to one per cent for 2016 for the city and a slightly lower rate for the region.

Todd Hirsch, chief economist for ATB Financial, agreed Edmonton’s real estate market will endure an economic slowdown better than other Alberta markets because of its more diversified economy.

‘I do see the Edmonton real estate market faring generally in better shape than Calgary or Fort McMurray this year,’ Hirsch said. ‘It’s the centre of government, health care and education – broader sectors that support employment growth in Edmonton. I don’t see the downturn in the real estate market in Edmonton to be as severe as it will be in other parts of the province.’

Christina Butchart, senior marketing analyst for the Canada Mortgage and Housing Corporation, said the situation has shifted from a market that slightly favored sellers to a buyers’ market because of larger inventory and fewer sales.

Meanwhile, despite Alberta’s economic slowdown, the assessed value of the average Edmonton house has still gone up this year, said municipal officials this week. The typical single-family detached home is now worth $408,000, up 1.7 per cent from last year. The average value of condos, townhouses and duplexes went up 4.8 per cent.”

After reviewing the REA annual housing forecast, Don Cholak recommends selling sooner rather than later. “If selling in the next year, with a negative forecast in place, the sooner you sell, the better price you will receive. If you are planning on moving up in 2016, you stand to gain the most in this type of market. Lower price homes will not be impacted as much as the upper end market will be in 2016.”