Source: http://www.remonline.com/6-things-to-consider-when-renting-property/

There are many factors to take into consideration when renting out a spare room or an unoccupied residence. Landlords and property managers want to attract respectful and dependable tenants, but in order to do so, they must go beyond just listing their property and hoping for the best.

Before they begin screening tenants or even setting up their listing, there are several steps your clients must take to avoid legal issues or nightmare tenants.

1. Get proper insurance

After deciding to rent out your property, notify your insurance company and receive proper insurance. Landlord’s insurance will protect you against damage to your property or any liabilities.

Should the property be damaged in a fire or storm, the insurance company will cover the cost of the repairs. However, many insurance claims do not cover damages caused by the tenant. Be sure to clarify in your claim with your insurance agent or inquire about adding on tenant insurance.

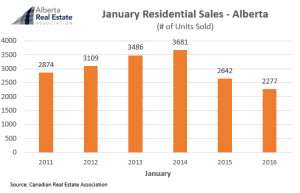

2. Be competitive about your pricing

Research the average pricing of rental properties in the market and set a competitive price. Avoid listing your property at the lowest rental price to attract more tenants; it will likely backfire because it will attract tenants who are only focused on price and who will leave in search of the next lower priced unit.

3. Understand landlord’s rights

It’s important that landlords know their rights and their tenants’ rights to avoid any lawsuits or legal issues. Canada Mortgage and Housing Corp. lists extensive information for each province on what landlords can and cannot do, including information on rent, pets and when a landlord can enter a unit when occupied by a tenant. Landlords should also consider joining a landlord’s association to stay up to date on changes to bylaws and regulations.

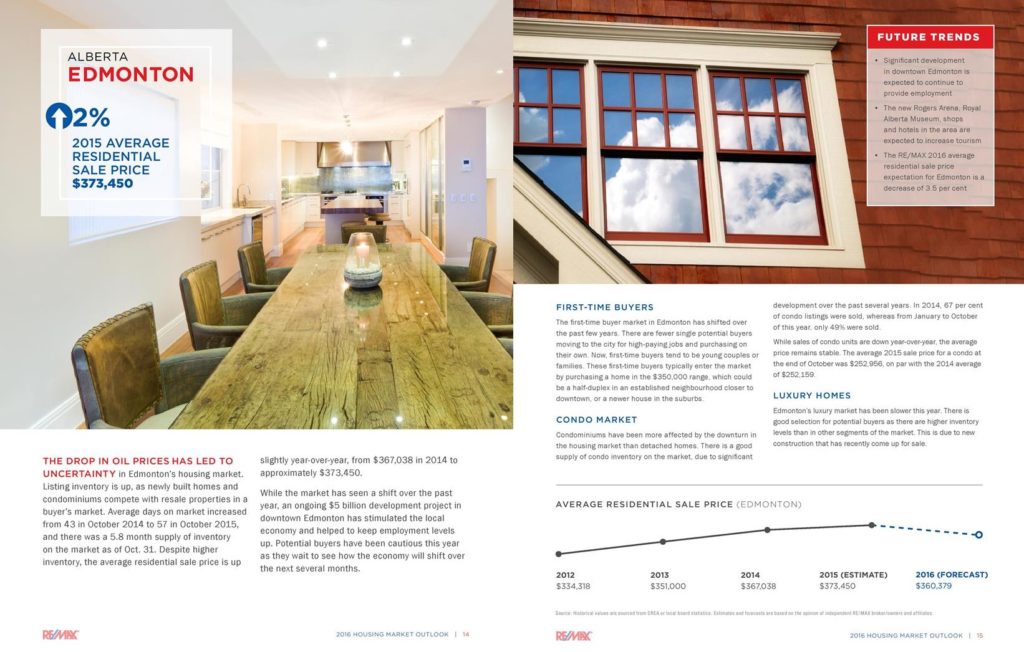

4. Photography goes a long way

The photos you select to post with your property’s listing can make a huge difference. Poorly lit photographs, whether they are too dark or over-exposed, can make a space look unappealing and unwelcoming. Photos that are blurry, grainy or low resolution can be difficult to make out and fail to properly showcase your space.

While a little bit of editing can make a photograph look more professional, over-editing can misrepresent your property. Prospective tenants won’t be pleased if they think your walls are snow white when they’re in fact light blue.

5. Maintain the rental property

If the rental property requires any repairs or is in need of a touch-up, be sure that they are conducted before viewings start. Prospective tenants are not going to be interested if the floorboards are dirty and damaged, or if the walls are in desperate need of painting. They also won’t be pleased if they rent out your property only to discover the heating is broken or the pipes need replacing. Create a space that is clean and comfortable; if you’re not comfortable living there, tenants won’t be either. After a tenant has moved in, be responsive and timely when they contact you should an issue arise.

6. Understand tax laws

Canada Revenue Agency requires that rental income is reported on your annual tax return, so it is important to know what can and cannot be deducted. Any reasonable expense – repairs or renovations, for example – incurred to earn your rental income can be deducted, but you cannot deduct the value of your own labour if you do the repairs or renovations yourself. If you’re unsure, the CRA provides a full list of expenses you can deduct, both current and capital, and what you cannot deduct.