Source: ATB’s “The Owl” Email Newsletter: https://mailchi.mp/195ed4ce3e82/the-owl-consumer-bankruptcies-begin-to-fall-again?e=6f1f3fb3a5

Albertans have reason to feel optimistic about the economy in early 2018. Oil prices have firmed up, the labour market continues to improve and, now, personal bankruptcies are on the decline.

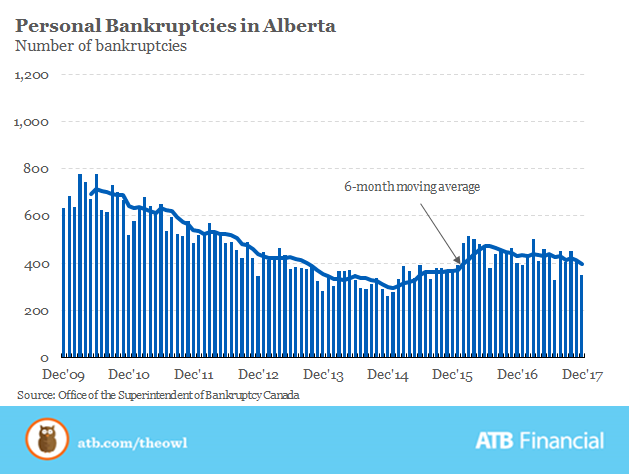

According to the latest statistics, insolvencies in the province fell to 350 (-10.4 per cent) in December, 53 lower than one month earlier. Compared to the previous December, when bankruptcies reached 401, the number of personal bankruptcies in Alberta is down by a little more than 13 per cent.

Throughout last year, consumer bankruptcies were on the decline. They picked up again in late-summer and autumn, in part because of increasing borrowing costs. The Bank of Canada increased its key interest rate in July and September, which made lending slightly more expensive for both consumers and businesses.

The Bank of Canada increased its key lending rate again at the beginning of this year with another announcement set for March 7th. Three rate increases in an eighth month window and the uncertain fate of Canada’s trade picture make it unlikely that consumers will face another rate increase this month. Given this and the economic recovery taking place in the province, consumer bankruptcies will likely level off or continue to drop.